What is Business and Landlord Insurance?

Business insurance is all about protecting your venture from the unexpected. Whether it’s public liability insurance, professional indemnity insurance, or employers liability insurance, these covers help keep things running smoothly. From commercial building insurance to product liability insurance, and even shop or tool insurance, there’s a policy tailored for every need. On the landlord side, insurance covers everything from buy-to-let insurance and landlord contents insurance to loss of rent and accidental damage cover. It’s a safety net for landlords and business owners alike, ensuring peace of mind in a world full of uncertainties.

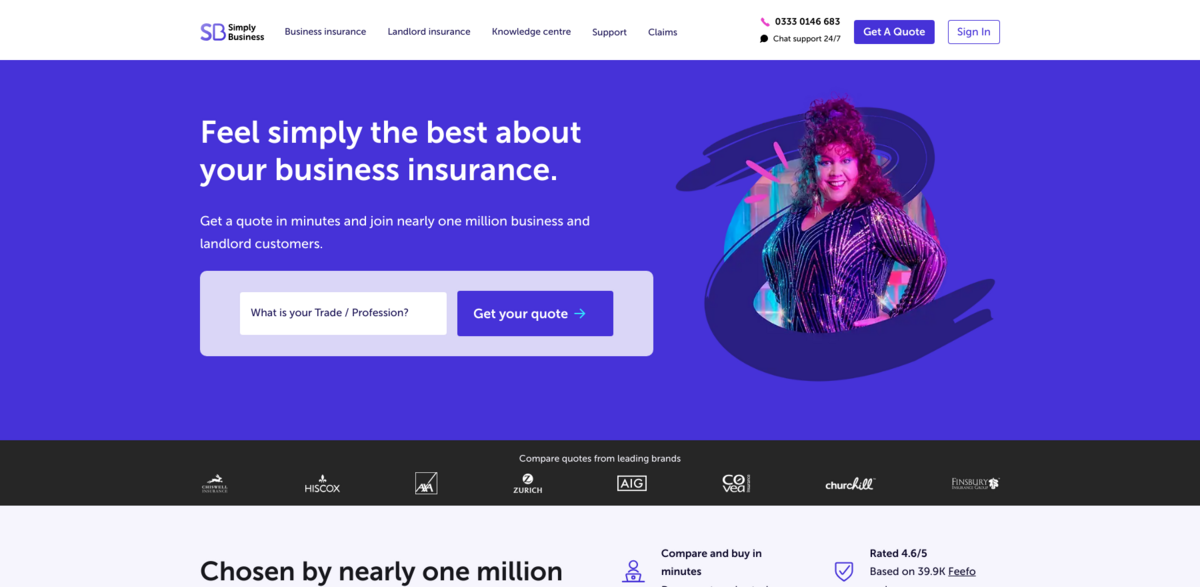

Main Benefits of Simply Business Insurance

Simply Business offers a wide range of insurance options designed to fit various trades and business types. Here are some key figures and facts that highlight its value:

- Extensive coverage options including commercial combined insurance and consultant insurance

- Specialized policies for tradesmen, self-employed, and sole traders

- Industry-specific insurance such as beauty therapist, catering, and cleaning insurance

- Dedicated landlord insurance products covering residential and commercial properties

- Supportive resources like profit margin calculators and VAT calculators to help manage business finances

- Campaigns promoting small business wellbeing and empowerment, like the Young Entrepreneur Fund and Empowering Women in Business

- A strong B Corp score of 89.2, reflecting commitment to social and environmental performance

Insurance Tailored for Every Business Type

Whether you’re a contractor, a limited company, or an online retailer, there’s insurance designed just for you. Tradesmen can find policies that cover their tools and public liability, while consultants and contractors have options that suit their unique risks. Manufacturing insurance and shop insurance provide specialized protection for those industries, and self-employed individuals or sole traders aren’t left out either. Simply Business makes it easy to find the right cover, no matter the business size or sector.

Landlord Insurance: More Than Just Buildings

Landlord insurance goes beyond just protecting the property. It includes landlord liability insurance, tenant default insurance, and alternative accommodation cover, among others. Whether it’s unoccupied property insurance or landlord accidental damage cover, these policies help landlords manage risks that come with renting out properties. From residential landlord insurance to commercial landlord insurance, the options are comprehensive and designed to keep landlords covered in all scenarios.

Knowledge and Resources to Empower Business Owners

Simply Business doesn’t just provide insurance; it also offers a wealth of knowledge and resources. The Knowledge Centre is packed with guides, small business news, and self-assessment tips. Research and reports like the SME Insights Report and the Generation Entrepreneur Report 2025 offer valuable insights. Plus, handy tools like profit margin calculators and VAT calculators help business owners stay on top of their finances. It’s about empowering businesses to thrive, not just survive.

Project Impact on Sustainable Development Goals (SDGs)

- SDG 8: Decent Work and Economic Growth – Supporting small businesses and entrepreneurs

- SDG 9: Industry, Innovation, and Infrastructure – Providing tailored insurance for diverse industries

- SDG 10: Reduced Inequalities – Campaigns like Empowering Women in Business promote inclusivity

- SDG 11: Sustainable Cities and Communities – Landlord insurance contributes to safer housing

- SDG 12: Responsible Consumption and Production – Encouraging sustainable business practices

Campaigns and Community Support

Simply Business runs several impactful campaigns aimed at supporting and uplifting the business community. From the Small Business Manifesto to the Stamp Out Tool Theft initiative, these efforts address real challenges faced by entrepreneurs. The Business Boost program and Mind Your Business campaign focus on wellbeing and growth, while the Young Entrepreneur Fund nurtures the next generation of leaders. These campaigns show a commitment to more than just insurance—they’re about building a stronger, more resilient business ecosystem.