What is the EU Taxonomy 2025 Webinar About?

Mark your calendars for Wednesday, 19th November 2025, at 11:00 AM for a live online webinar titled “EU Taxonomy 2025: Calculating GAR Under the New Rules – A Practical Guide for Banks.” This event, organised by Dydon AI in collaboration with SDH and ADVANTA, dives deep into the EU Taxonomy framework and its latest updates. The EU Taxonomy is essentially a classification system designed to determine whether an economic activity is environmentally sustainable. Its main goal? To bring clarity and transparency to investors, companies, and policymakers, helping everyone transition towards a low-carbon, resilient, and resource-efficient economy. The webinar promises practical insights, especially for banks, on how to calculate the Green Asset Ratio (GAR) under the new rules.

Main Benefits of Attending the Webinar

Why should banks and financial institutions tune in? Here’s what’s in store:

- Understand the EU Taxonomy’s role in sustainability classification and reporting

- Learn how the Green Asset Ratio (GAR) serves as the primary metric for banks

- Get hands-on guidance on calculating GAR under the updated 2025 rules

- Discover how to meet mandatory disclosure requirements using standardized KPIs

- Hear from experts collaborating with leading financial institutions across Europe

The Role of the Green Asset Ratio (GAR)

The Green Asset Ratio is at the heart of the EU Taxonomy’s financial reporting requirements for banks. It measures the proportion of a bank’s assets that are environmentally sustainable, based on the Taxonomy’s strict criteria. This metric is crucial because it helps financial institutions quantify and disclose their exposure to sustainable economic activities. The GAR is not just a number—it’s a powerful tool that drives transparency and accountability in sustainable finance. Banks can use it to showcase their commitment to green investments and align with the EU’s broader climate goals.

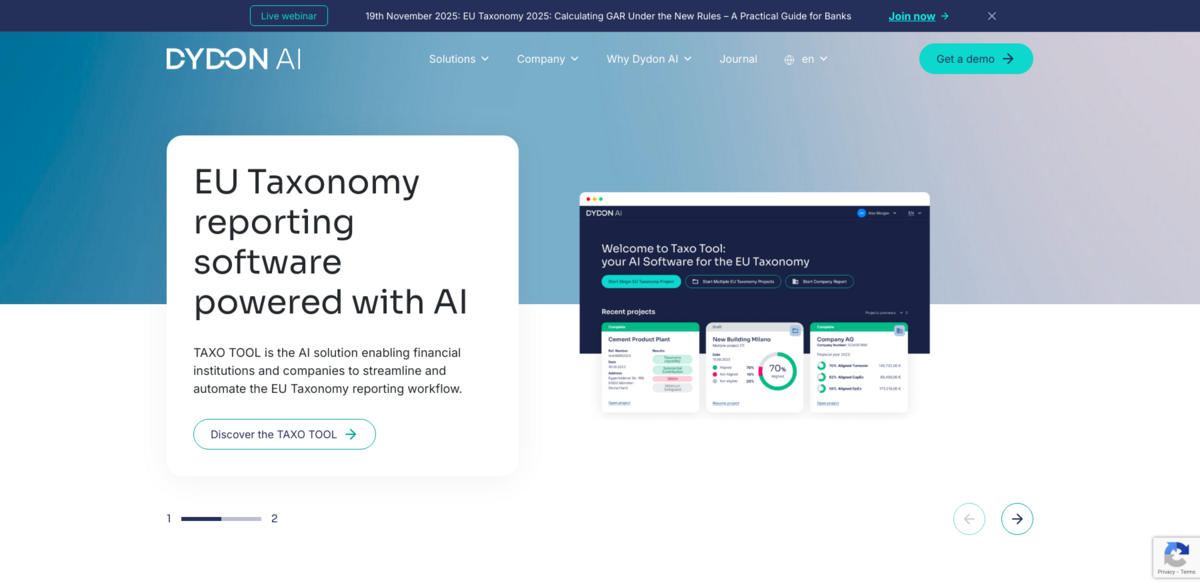

Introducing the TAXO TOOL: AI-Powered EU Taxonomy Reporting

Enter the TAXO TOOL, an AI-driven solution designed to simplify and automate the complex EU Taxonomy reporting process. This tool reads documents, extracts key data, answers regulatory assessments, and screens for sustainability criteria—all automatically and at scale. Imagine generating an audit-ready export in just a few clicks! The TAXO TOOL’s AI-based automation streamlines every stage of reporting, making compliance less of a headache and more of a breeze. It’s tailored specifically for banks but trusted by leaders across the finance sector.

Trusted Partnerships and Industry Collaboration

The TAXO TOOL wasn’t developed in isolation. It’s the result of close cooperation with the Association of German Public Banks (VÖB) and its subsidiary VÖB-Service GmbH. This collaboration ensures the solution meets the highest standards and addresses real-world challenges faced by financial institutions. Trusted by several banks across Germany and Europe, the TAXO TOOL reflects a commitment to quality, transparency, and innovation in sustainable finance. It’s a prime example of how fintech and regtech can come together to support compliance and sustainability goals.

Project Impact: Aligning with the Sustainable Development Goals (SDGs)

- SDG 7: Affordable and Clean Energy – Supporting investments in renewable energy projects

- SDG 9: Industry, Innovation, and Infrastructure – Promoting sustainable industrialization through transparent reporting

- SDG 11: Sustainable Cities and Communities – Encouraging green financing for urban development

- SDG 12: Responsible Consumption and Production – Enhancing resource efficiency via sustainable finance

- SDG 13: Climate Action – Driving the transition to a low-carbon economy through clear metrics

About Dydon AI and Its Commitment to Sustainable Finance

Dydon AI is a Swiss company specializing in transparent and flexible artificial intelligence solutions tailored for sustainable finance and compliance. Their focus lies in fintech and regtech, delivering cutting-edge tools that help financial institutions navigate complex regulatory landscapes. With a clear mission to support the transition to sustainable economies, Dydon AI’s innovations like the TAXO TOOL empower banks and companies to meet evolving standards with confidence and ease. Interested parties can also request a free demo to explore how these AI solutions can transform their EU Taxonomy reporting workflows.