What the Project Is

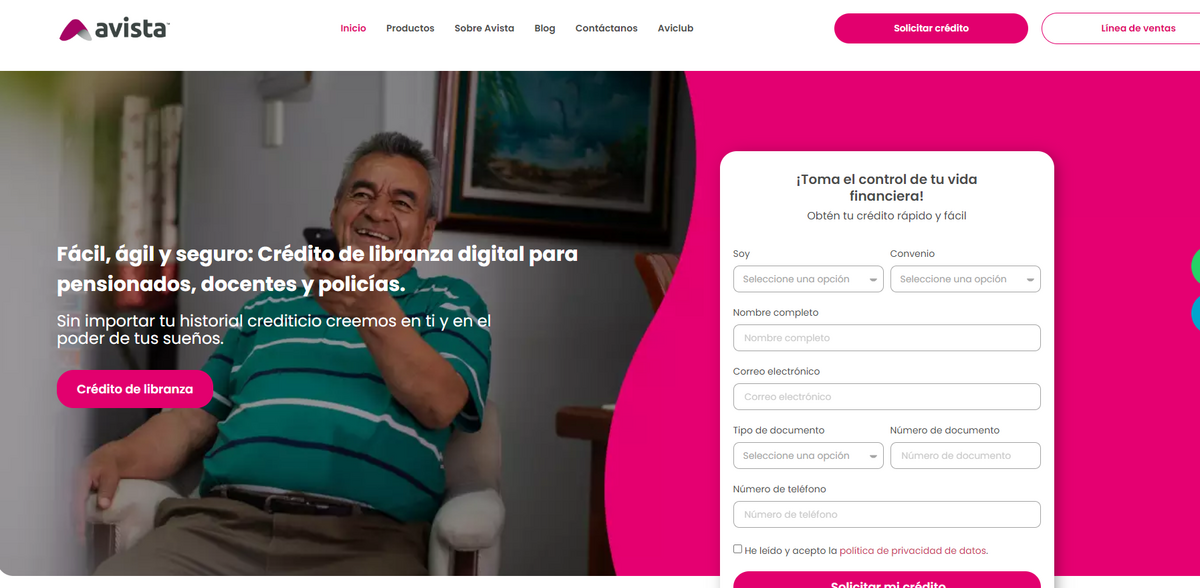

Avista presents a revolutionary option in the financial services industry – a digital credit designed specifically for pensioners, employees, teachers, and police officers. Featuring a unique blend of modern fintech solutions and a commitment to inclusión financiera, the project offers a payroll credit that transforms traditional lending practices. Based on a secure, digital process free from the hassle of long lines and redundant paperwork, this credit enables even those with less-than-perfect credit histories to access the funds they need. At its core, this financing option leverages the convenience of automatically deducted installments directly from payroll or pension, ensuring timely payments and easier management of financial responsibilities. Avista’s innovative approach places emphasis on the power of dreams and the belief that everyone deserves a chance, regardless of the past.

Main Benefit

The key advantages of this payroll credit are numerous and thoughtful – integrating benefits that set it apart in a competitive market:

- No complicated paperwork: A fully digital, streamlined process that eliminates physical procedures.

- No credit history required: Even if previous reports exist, credit becomes accessible.

- Flexible terms: Offering installments as long as up to 180 months, adapting to various financial capacities.

- High amounts available: With limits reaching up to $140 million, significant financial support is at hand.

- Quick approval: A fast, online process that cuts through bureaucratic delays in minutes without needing to visit an office.

- Latest security technology: Providing peace of mind and robust safeguarding of client information.

Digital Process and Client Experience

The project goes beyond traditional banking methods for payroll credits by embracing the digital era, making it incredibly fácil, ágil y seguro. This service is designed for those who crave control over their financial lives without the burden of slow, outdated methods. The simple simulation tool offers a real-time experience that shows potential clients exactly how their payments will be structured and how the borrowing process will seamlessly integrate with their payroll plans. The language used is both professional and friendly – inviting prospective clients to easily navigate through the process with well-laid-out steps. For many, this intuitive digital experience acts as a bridge between conventional banking and the modern touch of digital technology. It’s almost like having a knowledgeable friend guide you through every step… without any fuss.

Security and Flexibility

In a world where data security and financial stability are of paramount importance, the payroll credit from Avista stands out by marrying flexibility with robust security measures. The platform employs state-of-the-art security technology to ensure that every transaction and piece of client data is safeguarded at all times. The digital solution not only speeds up the approval process but also reassures those with concerns about online fraud or data breaches. This balanced approach provides a versatile yet secure financial tool, offering flexibility through adjustable terms and high credit limits while simultaneously ensuring that personal and financial information remains confidential and protected.

Eligibility & Requirements

Accessing this payroll credit is straightforward – the requirements are minimal, designed to welcome a wide audience. Prospective borrowers must simply hold an identity document and demonstrate sufficient payment capacity. The program is tailored for pensioners, teachers, and police officers who have an agreement with Avista. By keeping the entry requirements simple and focused on the end-user’s ability to repay rather than a lack of credit history, the project elevates financial inclusion. This approach directly supports the silver economy while contributing to the broader movement of bancarización and banca digital. It encourages those who might have been overlooked by traditional banks to join a modern, accessible financial system that values potential and real-life circumstances over rigid credit scoring.

Service and User Engagement

Clients who engage with this payroll credit will notice that the process is as captivating as it is effective. The interactive digital simulation allows users to clearly understand the benefits and responsibilities of borrowing, ensuring that every aspect of the product is transparent. Friendly online advisors and an extensive FAQ section add extra support, making it easier than ever to resolve any doubts. The messaging used in communications is clear, direct, and even a bit casual – giving borrowers confidence that this process is not just about numbers, but about real people who believe in their dreams. The consistent use of engaging language throughout the platform makes the experience both reassuring and energizing, a dynamic contrast to the often impersonal nature of traditional credit procedures.

Project Impact

- SDG 1 – No Poverty: Enabling access to credit empowers communities to achieve financial stability.

- SDG 8 – Decent Work and Economic Growth: Provides significant financial support to professionals, contributing to broader economic development.

- SDG 9 – Industry, Innovation, and Infrastructure: Embraces innovative digital processes in the fintech sector.

- SDG 10 – Reduced Inequalities: Enhances access by serving those with minimal or negative credit histories.

Financial Inclusion and Future Growth

This project not only redefines how credit is accessed and administered but also reinforces the importance of inclusivity in modern financial services. By building on core concepts such as fintech innovation, inclusividad financiera, and a commitment to the silver economy, the initiative provides a gateway to greater bancarización and banca digital. Clients can now see a future in which financial services are tailored to fit their personal circumstances – an approach that places control firmly in their hands. The forward-thinking use of technology combined with an unwavering focus on the customer experience paves the way for smoother transitions into digital financial landscapes. In essence, this payroll credit product is more than just a lending tool; it is a catalyst for financial empowerment, opening doors for those who had been limited by conventional credit restrictions. The blend of precision, security, and flexibility encourages a new standard in the industry, ensuring that dreams and financial stability walk hand in hand, every step of the way.