What is Nithio?

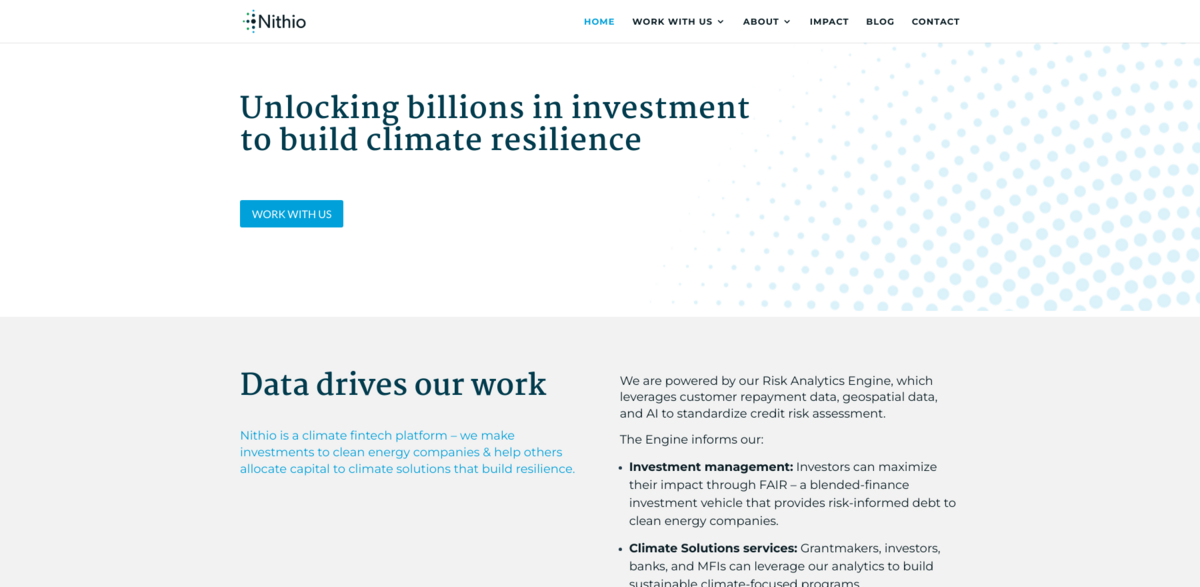

Nithio is a climate fintech platform that’s all about making smart investments in clean energy companies and helping others channel capital into climate solutions that build resilience. At its core, Nithio is powered by a Risk Analytics Engine. This engine uses customer repayment data, geospatial info, and AI to standardize credit risk assessment. It’s like having a super-smart assistant that helps investors and organizations make better decisions when it comes to funding climate-friendly projects.

Main Benefits of Nithio’s Approach

Here’s a quick snapshot of what makes Nithio stand out:

- Only 5% of global climate finance is directed exclusively to adaptation and resilience, highlighting a huge gap Nithio aims to fill.

- Sub-Saharan Africa contributes just 3% of global emissions but faces the biggest climate resilience challenges.

- Universal energy access, especially from clean sources, boosts quality of life, economic mobility, financial inclusion, health, safety, and education.

- Investors can maximize impact through FAIR – a blended-finance vehicle offering risk-informed debt to clean energy companies.

- Grantmakers, banks, and MFIs can leverage Nithio’s analytics to build sustainable, climate-focused programs.

How Nithio Drives Investment in a Just Energy Transition

Nithio was created to significantly increase climate finance in underserved markets, especially in regions like Sub-Saharan Africa. The platform focuses on financing companies that build climate resilience and support a just energy transition. This means providing flexible debt financing to distributed energy companies, helping them grow their operations and reach more communities with clean energy solutions.

The Power of the Risk Analytics Engine

The Risk Analytics Engine is the heart of Nithio’s platform. By leveraging repayment data, geospatial insights, and AI, it standardizes credit risk assessment. This not only informs investment management but also helps various stakeholders—like investors, grantmakers, and banks—allocate capital more effectively, assess risks accurately, monitor performance, and track impact. It’s a game-changer for climate finance, especially in markets that have traditionally been underserved.

Why Climate Resilience Matters

With climate change impacts growing every day, the urgency to invest in resilience has never been higher. Yet, only a tiny fraction of climate finance targets adaptation and resilience. Sub-Saharan Africa, despite its low emissions, is the least climate-resilient region globally. Universal energy access, particularly from clean sources, is a key part of building resilience. It improves lives, supports economic growth, and strengthens communities against climate shocks.

Impact on Sustainable Development Goals (SDGs)

- SDG 7: Affordable and Clean Energy

- SDG 13: Climate Action

- SDG 1: No Poverty

- SDG 3: Good Health and Well-being

- SDG 8: Decent Work and Economic Growth

- SDG 10: Reduced Inequalities

- SDG 11: Sustainable Cities and Communities

Nithio’s Role in Africa’s Energy Future

As a venture-backed energy finance platform, Nithio serves businesses, capital providers, governments, and other stakeholders in Africa’s distributed solar sector. It addresses the urgent need for modern energy access by providing a sustainable infrastructure for capital delivery. Plus, it offers state-of-the-art underwriting tools and a powerful information-sharing platform. This helps stakeholders identify high-need grant recipients and credit-worthy customers, making the whole ecosystem more efficient and impactful.