What the Project Is

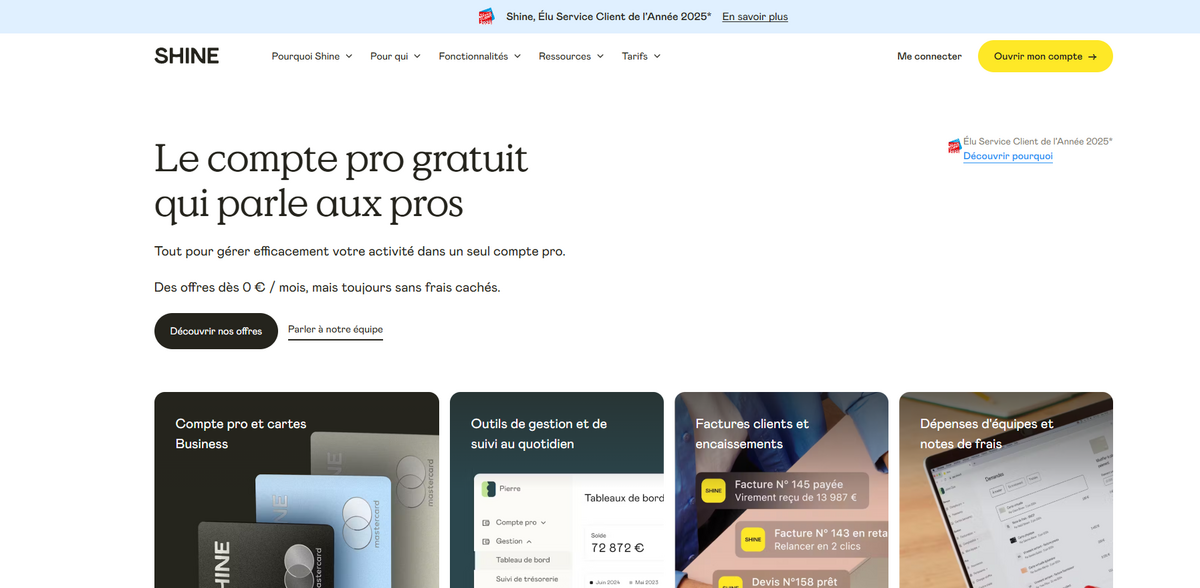

Shine, awarded Customer Service of the Year 2025* in the category of Online Banking for Businesses, is a payment institution committed to responsible banking. Registered at 122 rue Amelot, 75011 Paris and authorized by the ACPR (French Prudential Supervisory Authority) under number 71758, Shine is designed to cater to the professional world—from e-commerce to agencies, startups, TPE, and PME. Offering everything needed to manage a business efficiently in a single professional account, Shine is the solution for independents, freelancers, SMEs, and startups alike… It embraces transparency with offers starting from €0/month, with no hidden fees, ensuring that professionals know exactly what they pay, without surprises.

Main Benefit

- Awarded Customer Service of the Year 2025* for Online Banking for Businesses

- Payment institution authorized by the ACPR under number 71758

- Registered office located at 122 rue Amelot, 75011 Paris

- Offers a free professional account designed for professionals from e-commerce, agencies, startups, TPE, and PME

- No hidden fees, starting from €0/month, always without surprises…

- All deposits are secured in a segregated account at Société Générale, protecting funds even if Shine goes bankrupt

Different Topic: Comprehensive Banking Services

Shine provides complete banking services tailored to the daily needs of professionals. With a free account that contains the essentials of a professional account and invoicing, the offering is ideal to help get started without fees and without commitment. The account is built to simplify administrative tasks for independents, freelancers, and SMEs. It offers a modern neobank experience, ensuring fast and efficient banking operations. This service is 2 to 4 times cheaper than a traditional bank’s professional account, making it the go-to choice for those who appreciate transparency in pricing and dedicated support. Shine’s efficiency, clarity, and simplicity make it a standout option in online banking.

Different Topic: Security and Transparency

Customers’ money is safe with Shine. Every euro deposited is protected in a segregated account at Société Générale, which means funds are neither invested nor lent and remain secure even if the institution faces financial difficulties. This robust security measure ensures complete peace of mind. Shine maintains full transparency regarding its operation, with offers beginning from €0/month and always without hidden fees. This commitment to clear, honest banking is what makes Shine resonate with business owners seeking reliable financial management.

Different Topic: Commitment to Responsible Banking

Shine is not only focused on providing efficient and modern banking solutions but also on building a better world. Certified B Corp, an international label recognizing companies that strive to be the best for the world, Shine donates 1% of its annual revenue to organizations protecting the environment. This social responsibility, combined with a strong dedication to regulatory compliance and customer service excellence, reinforces Shine’s image as a forward-thinking institution. Furthermore, Shine is preparing to become a Partner Dematerialization Platform, which will ensure the seamless transmission of invoices to comply with new regulations—an essential tool for businesses adapting to evolving digital requirements.

Different Topic: Packages for Company Creation

In addition to the free professional account, Shine offers specialized packages for company creation. These packages include services such as capital deposit and professional accounts with or without commitment, essential to streamline the startup process. Designed for a variety of business activities including banking, admin, accounting, and even insurance, Shine’s solutions cater to startups and SMEs alike. The measurable cost savings, ease of administrative management, and responsive customer service make Shine a reliable partner for entrepreneurs at every stage of their business journey.

Project Impact

- SDG 8 – Decent Work and Economic Growth

- SDG 9 – Industry, Innovation and Infrastructure

- SDG 12 – Responsible Consumption and Production

- SDG 13 – Climate Action

Different Topic: The Future of Professional Banking

Shine exemplifies innovation in the other financial services industry with a bcorp score of 99.1 and a mission centered on clarity and cost-efficiency. By being on average 2 to 4 times cheaper than a traditional bank’s professional account, it challenges the norm and redefines what responsible banking looks like in today’s digital age. With a strong foothold in banking, admin, and accounting, and a keen focus on both independents and larger business structures, Shine continues to expand its reach by addressing the multifaceted needs of modern business owners. The conversation around efficient financial management has changed, and Shine’s blend of secure banking, transparent pricing, and meaningful social impact is setting the standard for how professionals will bank in the future. It is a solution that keeps pace with the evolving world while always maintaining its integrity and commitment to the wellbeing of business and the planet.