What the Project Is

ROOTFUND is an innovative project operating in the realm of other financial services, delivering opportunities in renewable energy, finance, and fintech. The platform is designed to offer corporate investment opportunities through services such as a Corporate Investment Guide and Bond Exchange, as well as tailored loan solutions and direct investment options. The project’s mission centers around enabling community participation in sustainable and eco-friendly energy initiatives, with a strong emphasis on renewable energy, solar energy, and impact investment. With a bcorp score of 92.6, ROOTFUND transforms traditional finance into a dynamic ecosystem that bridges the gap between community engagement and climate change awareness.

Main Benefits

Key benefits and figures associated with this project include:

- Cumulative Loan Amount: 65.4 billion KRW

- Cumulative Investment Count: 12,385 cases

- Production Power Generation: 455.21 million

- Air Pollution Reduction: 133,289 units

- Environmental Impact: About 26,868,458 trees 🌲 and significant carbon dioxide reduction

Investment and Loan Options

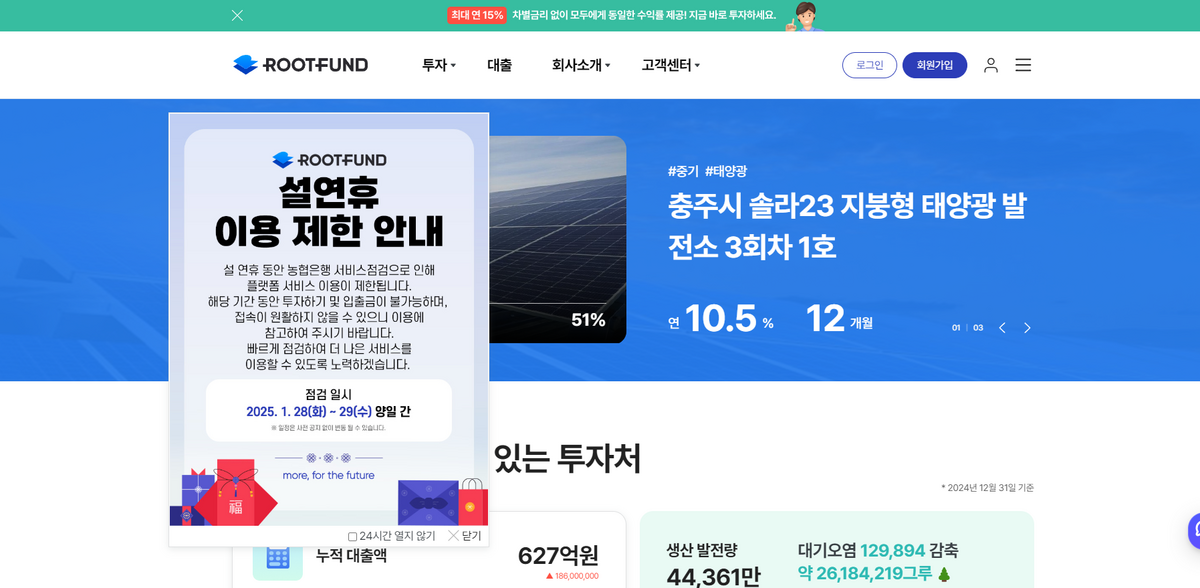

The ROOTFUND project offers a variety of investment and loan opportunities. Users can explore investment types such as Corporate Investment and Bond Exchange. Loan options are clearly defined, with repayment details and durations that include annual interest payments (e.g., an annual 10.5% rate for 12 months). Investment amounts start as low as 10,000 KRW, and the process ensures fast, frictionless membership registration along with complete transparency in after-tax yield and quarterly interest payments. It’s a straightforward approach where every detail, from loan execution nuances to early repayment possibilities, is thoughtfully laid out.

Community and Sustainable Energy

The project is more than just numbers – it serves as a bridge between renewable energy development and community participation. Various news items highlight the local impact, such as Shinansan County’s emphasis on citizen participation in renewable energy investment, and Yeongdeok’s success in wind power recruitment where 100% citizen direct investment has boosted the local economy. There’s also coverage from prominent news outlets like Hans Economic, Gyeongbuk Newspaper, and Money Today, showcasing stories about root energy initiatives, local acceptance of renewable projects, and even recognitions like reaccreditation as a global social enterprise ‘B Corp’. These narratives underline that ROOTFUND is not only about finance but also about empowering communities and tackling climate challenges.

Transparency and Trust

Maintaining trust through full transparency is at the heart of ROOTFUND. Public disclosure information is meticulously shared, including details such as:

– Cumulative Loan Amount: 65,431,000,000 KRW

– Loan Balance: 12,106,099,203 KRW

– Repayment Income: 48,453,285,157 KRW

– Profit: 46,985,735,173 KRW

– Repayment: 53,324,900,797 KRW

– Delinquency Rate: 0% with a delinquent amount of 0 KRW

This level of clarity ensures that every investor and borrower can assess the financial health of the project with confidence. There’s a strong commitment to providing all necessary details, making it easier for interested parties to understand both the opportunities and responsibilities entailed.

Project Impact

- SDG 7: Affordable and Clean Energy

- SDG 9: Industry, Innovation and Infrastructure

- SDG 11: Sustainable Cities and Communities

- SDG 13: Climate Action

- SDG 17: Partnerships for the Goals

Customer Engagement and Additional Information

Additional project details underscore ROOTFUND’s commitment to customer service and community outreach. The platform offers a customer center with various resources including notices, frequently asked questions, guides on how to use the system, and promotional information. With a representative director such as Yoon Tae-hwan and a robust business registration (106-87-04057), the project solidifies its professional standing and accountability. The address is provided at 5, Ttukseom-ro 1na-gil, Seongdong-gu, Seoul, and inquiries can be directed to 02-792-8934. It is important to note that loan interest rates include platform usage fees, up to a maximum of 19.90% per annum, and delinquency interest rates are subject to legal limits at a maximum of 20% per annum. The structure allows for flexible early repayment (full amount) at any time after the loan is executed, with no prepayment fees involved.