What Anchor Loans Is All About

Anchor Loans is the nation’s leading private, direct lender catering to experienced residential real estate investors, brokers, and builders. They’re all about enabling the builders shaping the future of housing by offering the resources, expertise, and partnership needed to get projects off the ground and thriving. Whether it’s flipping homes, building new communities, or developing raw land, Anchor Loans steps in with tailored lending solutions that fit the scale and ambition of each project.

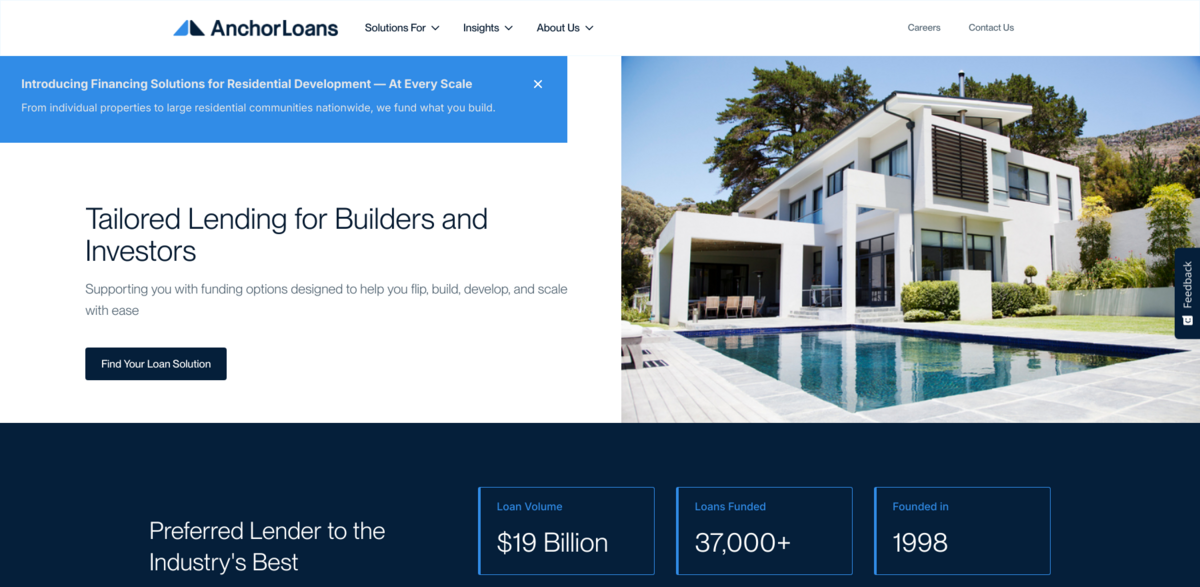

Main Benefits and Key Figures

When it comes to financing, Anchor Loans really delivers. Here’s a quick snapshot of what they bring to the table:

- Loan Volume: $19 Billion funded so far

- Loans Funded: Over 37,000 deals completed

- Founded: Since 1998, with decades of experience

- Repeat Borrowers: A solid 85% come back for more

- Homes Constructed: More than 53,000 homes built

- Lending Reach: Active in 48 states across the U.S.

Tailored Lending for Every Real Estate Player

Anchor Loans isn’t just a one-size-fits-all lender. They understand the unique needs of different players in the housing market. Renovators get the capital to transform properties into valuable assets. Builders receive funding to kick off new housing projects from scratch. Land developers and bankers unlock the potential of raw land, fueling future construction. Rental portfolio investors can expand their holdings and maximize returns. And brokers and advisors connect their clients with customized capital solutions. It’s a full spectrum approach that keeps the American housing market moving forward.

Financing Solutions That Work for You

Fast, flexible, and designed to scale success — that’s the promise Anchor Loans makes. They streamline the path to financing, cutting through the red tape so builders and investors can focus on what they do best: building, renovating, and developing. From individual properties to sprawling residential communities nationwide, Anchor funds what you build, no matter the size or complexity.

Insights and Market Trends

Keeping a finger on the pulse of the housing market is crucial, and Anchor Loans shares valuable insights through their blog and news updates. Topics like the easing pressure in the housing market, the rise of Non-QM lending in 2025, and real estate investment outlooks help investors and builders stay informed and ahead of the curve. These insights aren’t just data points — they’re tools that empower smarter decisions in a dynamic market.

Project Impact and Sustainable Development Goals (SDGs)

- SDG 11: Sustainable Cities and Communities — by supporting attainable housing and new developments.

- SDG 8: Decent Work and Economic Growth — through job creation in construction and real estate sectors.

- SDG 9: Industry, Innovation, and Infrastructure — by financing innovative building projects and infrastructure development.

- SDG 1: No Poverty — helping increase access to affordable housing options.

- SDG 10: Reduced Inequalities — by promoting social impact through build-to-rent and community-focused projects.

Why Anchor Loans Stands Out in Real Estate Lending

What really sets Anchor apart is their deep understanding of the real estate credit landscape and their commitment to social impact. They’re not just about lending money; they’re about building futures. With a B Corp score of 116.8, they demonstrate a strong dedication to responsible business practices and positive community impact. Their focus on attainable housing, construction, and development means they’re helping shape a more inclusive and sustainable American housing market — one loan at a time.