What is Triodos Bank?

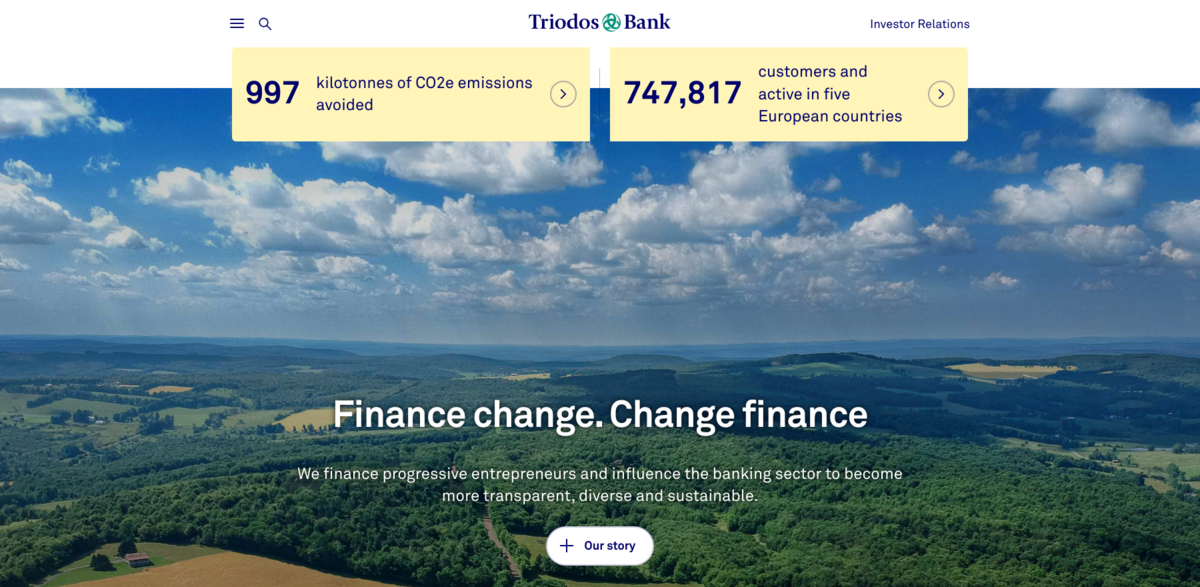

Triodos Bank N.V. stands out as a frontrunner in sustainable banking, consistently pushing the boundaries of what it means to finance with purpose. Recognised as the most active clean energy arranger by independent analyst Clean Energy Pipeline, Triodos Bank is deeply committed to supporting projects that benefit both people and the planet. From its roots in the Deposit bank sector within Developed Markets, it carries a B Corp score of 131.3, reflecting its strong dedication to social and environmental performance. The bank’s operations span various initiatives, including nature restoration, sustainable farming, and transparent impact investing, all designed to create a more just and humane society.

Main Benefits and Key Figures

Triodos Bank’s recent achievements and updates highlight its robust position and ongoing impact:

- 11.7 million Depository Receipts (DRs) registered through individual settlement agreements.

- Received the 2025 Supervisory Review and Evaluation Process (SREP) decision from De Nederlandsche Bank N.V. (DNB), setting prudential requirements.

- Fitch Ratings revised the Outlook on Triodos Bank’s Long-Term Issuer Default Rating (IDR) to Stable from Negative, affirming the IDR at ‘BBB’ and Viability Rating at ‘bbb’.

- Successfully priced EUR 300 million of MREL eligible Green Senior Preferred Notes under its Debt Issuance Programme.

- Reported a net profit of EUR 17.0 million, despite additional provisions due to high settlement offer acceptance, alongside a strong CET 1 ratio of 18.1%.

- Updated minimum standards to ensure financed companies do no harm to people and planet.

Leadership and Strategic Changes

The Supervisory Board of Triodos Bank N.V. recently made some notable appointments and reappointments that signal a clear focus on transformation and innovation. Suzanne Schilder was appointed as Chief Transformation Officer (CTO), while Barbara van Duijn took on the role of Chief Information Officer (CIO). Meanwhile, Jacco Minnaar was reappointed as Chief Commercial Officer (CCO) for a second term. These leadership moves are designed to steer the bank through its next phase of growth and sustainability, ensuring it remains at the forefront of ethical banking practices.

Operational Shifts and Market Focus

In a strategic move, Triodos Bank announced its intention to wind down its German operations. This decision reflects a sharper focus on markets where the bank can maximize its impact and align more closely with its mission. Meanwhile, the bank continues to engage actively with European climate initiatives, such as the EU Commission’s 2040 climate target proposal, emphasizing the need to channel capital into homegrown climate innovation that reduces emissions, strengthens energy security, and creates green jobs.

Innovative Projects and Thought Leadership

Triodos Bank is not just about financing; it’s about leading change. Projects like Wilder Land are restoring the Netherlands to its wilder roots—strip by strip, species by species—empowering farmers and restoring nature through sustainable practices. Meanwhile, Sumthing is transforming nature restoration by making every euro donated visible and traceable, offering real-time updates and transparent impact tracking. On the thought leadership front, Triodos Bank economists like Joeri de Wilde and Chief Economist Hans Stegeman challenge conventional wisdom, sparking conversations about the role of finance in society and the metaphorical weight of issues like plastic pollution.

Project Impact on Sustainable Development Goals (SDGs)

- SDG 7: Affordable and Clean Energy – through active clean energy financing.

- SDG 8: Decent Work and Economic Growth – by creating green jobs and supporting sustainable businesses.

- SDG 12: Responsible Consumption and Production – via updated minimum standards ensuring no harm to people and planet.

- SDG 13: Climate Action – aligning with EU climate targets and promoting homegrown climate innovation.

- SDG 15: Life on Land – through nature restoration projects like Wilder Land.

- SDG 16: Peace, Justice, and Strong Institutions – advocating for human rights and ethical investment choices.

Ethical Commitment and Social Responsibility

The financial sector often faces criticism for turning a blind eye to human rights violations, but Triodos Bank takes a different stance. The recent images from Gaza have stirred feelings of upset and powerlessness, and Triodos Bank insists that finance must not ignore such realities. Instead, it uses its influence to encourage change and prioritizes investments that contribute to a just and humane society. This ethical commitment is woven into every aspect of the bank’s operations, from its financing criteria to its public statements, reflecting a deep responsibility toward global social justice.