What Maze Impact Is About

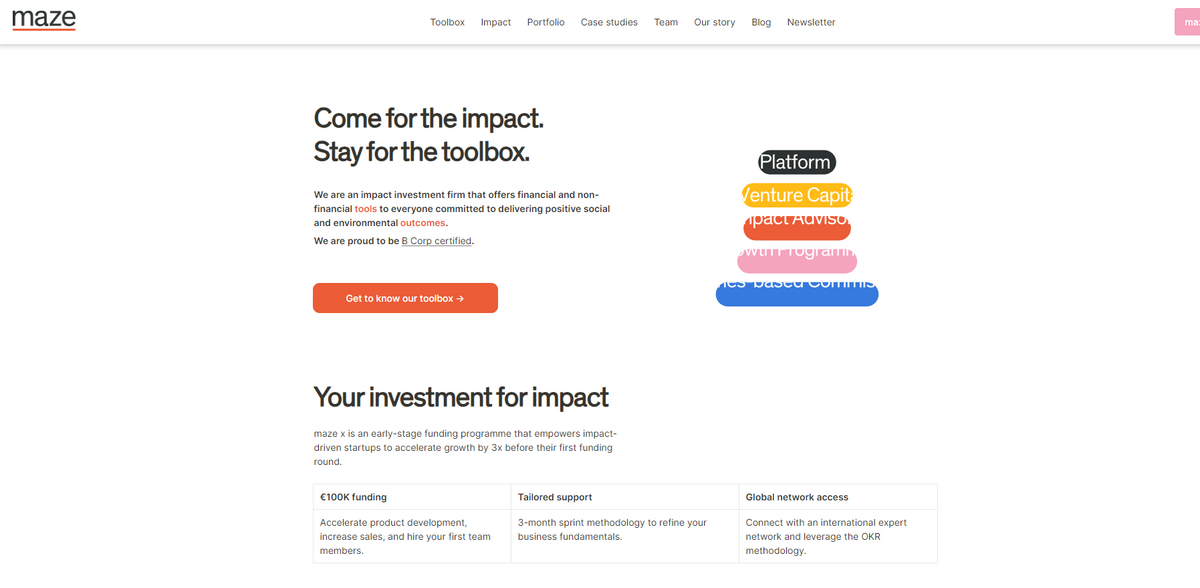

MAZE IMPACT is an impact investment firm offering both financial and non-financial tools to everyone committed to delivering positive social and environmental outcomes. This organization stands out by proving that impact is the greatest economic opportunity of our time. With its foundation rooted in the belief that every stakeholder benefits from purpose-driven endeavours, Maze Impact demonstrates its commitment through a robust array of services. Its status as a B Corp—with certification proudly displayed on their profile—further reinforces confidence and transparency in its practices. It’s a case of purposeful investing meeting cutting-edge financial tools, and yes, it really shows.

Main Benefits and Key Figures

Below is a snapshot containing key figures and core facts that highlight Maze Impact’s establishment and influence:

- Certified Since: August 2021

- Overall B Impact Score: 121.3 (compared to a median ordinary business score of 50.9)

- Industry: Equity investing – Developed Markets

- Sector: Service with Minor Environmental Footprint

- Operates In: Portugal

The Toolbox of Innovation

At the heart of the project lies an impressive toolbox—its collection of both financial and non-financial instruments. This toolbox includes venture capital, impact advisory, growth programmes, and more. Such tools are designed with one clear purpose: to enable investors, founders, and corporate entities to bundle several instruments together, so they may serve business outcomes and impact ambitions effectively. The approach is dynamic… seamlessly blending conventional investment structures with innovative methods. Emphasis is placed on sustainable finance and outcomes-based commissioning while not forgetting the need for acceleration and social impact bonds in modern financial practices.

Case Studies and Latest News

Maze Impact’s portfolio is also enriched by insightful case studies and the constant buzz of its latest news. Real-world examples include collaborative efforts with founders who are treated like clients—a practice that reiterates the firm’s commitment to personalizing impact management. In recent news, the firm has highlighted its determination by stating, “Still here: the time to take ownership of sustainability reporting,” and raising thoughtful questions such as “Why are we launching a social housing fund for homelessness in Lisbon?” These updates not only reflect the firm’s proactive stance in today’s fast-evolving investment environment but also showcase its drive to harness innovative acceleration approaches while emphasizing sustainable impact.

Talent Pool and Job Board

Beyond its impressive financial services, Maze Impact extends opportunities through a comprehensive job board and a talent pool. The job board lets interested professionals browse open opportunities, filter by industry, location, and even preferred Sustainable Development Goals (SDG), all while applying to do the things they love—be it in product, business development, software engineering, and other related fields. Simultaneously, the talent pool serves as a dynamic platform where impact-driven entrepreneurial candidates are contacted by teams of like-minded organizations when a matching opportunity arises. Both initiatives demonstrate the firm’s commitment to fostering an ecosystem of growth and sustainability, blending innovative acceleration with traditional investment methodologies.

Impact Management and Sustainable Strategies

Central to the overall strategy is Maze Impact’s robust framework for impact management. The firm has designed its tools to be optimized and effective—positioning the pursuit of positive environmental and social outcomes squarely at the forefront of its operations. Whether it is through venture capital investments, growth programmes or specialized advisory services, the focus remains clear and convincing: impact is not just a by-product but the core objective of every initiative. With a portfolio that includes acceleration, social impact bonds, and outcomes-based commissioning, the approach provides a diverse array of pathways that align financial returns with sustainable value creation.

Project Impact and SDGs

- SDG 1: No Poverty

- SDG 8: Decent Work and Economic Growth

- SDG 11: Sustainable Cities and Communities

- SDG 13: Climate Action

Confidence in Impact: A Future Shaped by Sustainable Finance

Maze Impact’s mission is clear and conversational—a dedication expressed through the blend of creative financial engineering and long-term impact management. With its integrated approach encompassing impact investing, accelerator concepts, and even venture capital, the organization ensures that every investment is aligned with achieving measurable social and environmental outcomes. The integration of growth programmes and impact advisory services not only supports a diverse array of business needs but also builds an investment ecosystem where social impact bonds and outcomes-based commissioning play key roles. This robust commitment to sustainable finance has not only garnered trust in Portugal’s developed market but also underscores a willingness to adopt fresh, impactful strategies that resonate well beyond traditional finance.