What is Banqer?

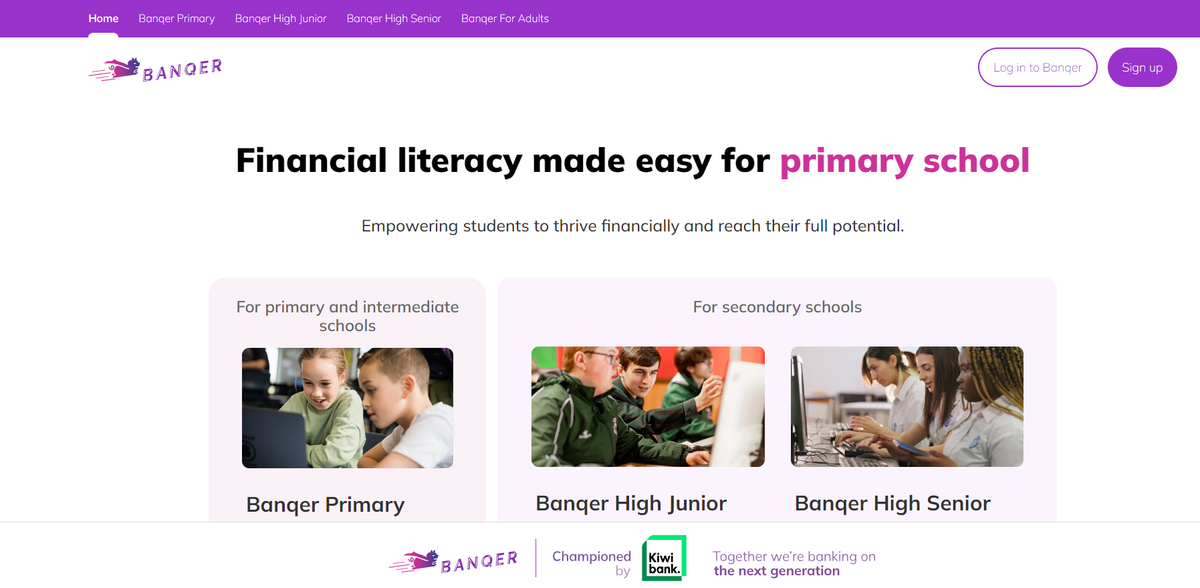

Banqer Primary, Banqer High Junior, and Banqer High Senior are innovative educational programs designed for primary, intermediate, and secondary schools. For primary and intermediate schools, Banqer Primary is designed for Years 5-8; it explores money and math basics with income, expenses, banking, tax, and more. Meanwhile, for secondary schools, Banqer High Junior is crafted for Years 9-11, building skills around careers, budgeting, investments, and more, and Banqer High Senior is geared toward Years 11-13 to help students prepare for life after school – juggling study, renting, living costs, wellbeing, and other real-life challenges. This comprehensive approach empowers students to thrive financially and reach their full potential, all while having a bit of fun along the way…

Main Benefits and Key Figures

Educators love Banqer for several reasons — it delivers real impact, captivates student engagement, and is incredibly easy to use. In summary, key benefits include:

- IMPACT: Grows students’ true financial capability and creates real-life impact.

- ENGAGEMENT: Engages every student and sparks curiosity beyond the classroom.

- MADE EASY: Saves precious time through flexible and curriculum-aligned learning resources.

Exploring the Dynamic Curriculum

At the heart of Banqer lies its thoughtful curriculum that caters to a range of learning stages. Banqer Primary introduces money matters through income, expenses, and the basics of banking and tax, giving young learners a head start in understanding finances. Banqer High Junior shifts the focus towards real-life challenges, such as budgeting and making investments, ensuring that every student begins to appreciate the role that financial know‐how plays in everyday decisions. Banqer High Senior takes this learning one step further by preparing students for life after school – whether it’s managing study commitments or balancing living costs. These resources are designed to be easy, engaging, and purpose-driven, making financial literacy accessible and fun.

How Banqer Works in the Classroom

Financial education does not have to feel daunting or inaccessible. Through simple steps, educators can get started with Banqer: register as a teacher, create a classroom, and add students. Once set up, Banqer transforms conventional lessons into dynamic sessions that breathe life into financial education. The process is streamlined and straightforward – a quick registration paired with a flexible approach to lesson implementation results in an enriched learning experience that keeps learners curious and involved.

Tools, Resources, and Community Support

Banqer is more than just a curriculum; it’s a comprehensive tool endorsed by the community and supported by prominent organizations such as Kiwibank. With user-friendly design and an emphasis on real-life impact, educators find it easy and exciting to incorporate into their daily teaching schedules. Whether tapping into interactive learning modules or consulting with a thriving network of educators, Banqer stands out as a partner in imparting financial literacy. This support makes it possible for educators like Claire Yee – who recently returned to full-time teaching – to effortlessly deliver an exciting and comprehensive financial education programme.

Innovative Learning for Diverse Age Groups

The structure of Banqer is deliberately segmented to address the needs of learners at different growth stages. Banqer Primary is ideal for building foundational skills in Years 5-8, while Banqer High Junior gears up students in Years 9-11 with essential life skills such as budgeting and understanding investments. For those approaching the end of secondary school, Banqer High Senior provides a practical guide to managing life after school, covering a range of issues from balancing study and leisure to coping with living costs. The structured progression ensures that at every stage, students gain the relevant knowledge and skills applicable in the real world… It really helps to see a clear path from basic to more advanced financial concepts.

Project Impact and SDGs

- SDG 4: Quality Education – Promoting lifelong learning and skill development through structured financial literacy programmes.

- SDG 8: Decent Work and Economic Growth – Equipping students with the financial skills needed to navigate real-world economies.

- SDG 10: Reduced Inequalities – Providing accessible, curriculum-aligned resources that make education more inclusive.

Community and Future Directions

Banqer is celebrated as an internationally recognised leader in financial education, with a supportive network that spans educators and community organisations alike. The initiative empowers young learners to build on their knowledge and confidently take on the financial challenges of modern life. With inspiring success stories and endorsements from both teachers and financial institutions, Banqer continues to set a high standard. Its modular design allows it to adapt seamlessly to varied learning environments while remaining true to its core mission of equipping every student with the necessary financial skills. As classrooms evolve and teaching methods become increasingly digital, Banqer’s blend of traditional curriculum elements with innovative techniques remains a reliable resource for educators. The positive impact is evident in every lesson, every classroom and every student who embarks on the journey to financial literacy.