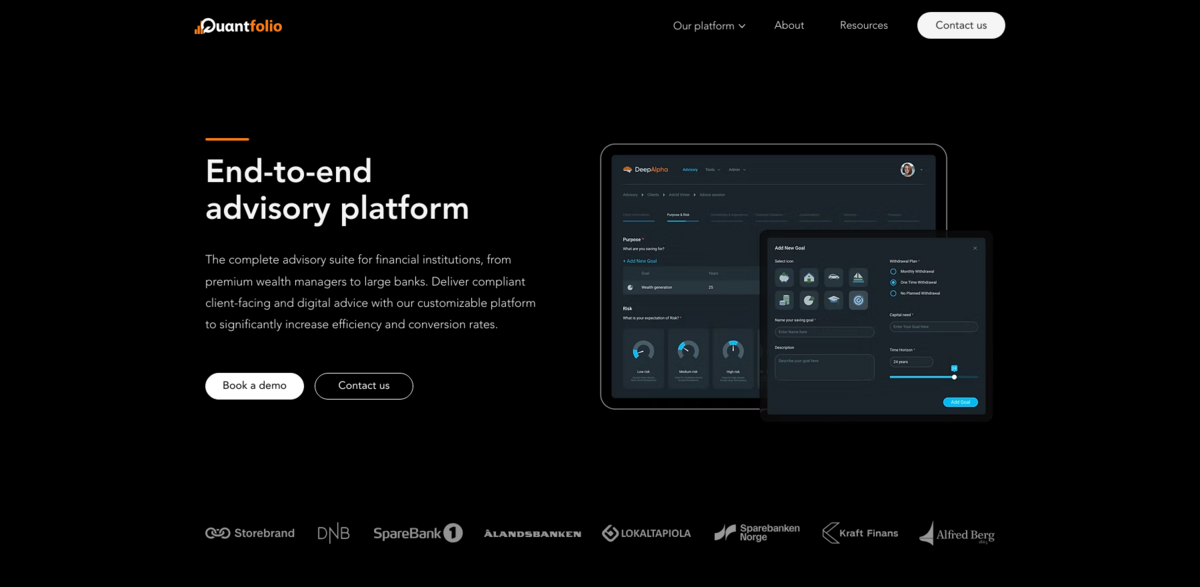

What is the End-to-End Advisory Platform?

Imagine a complete advisory suite designed specifically for financial institutions—whether you’re a premium wealth manager or a large bank. This platform delivers compliant, client-facing, and digital advice through a customizable system that’s built to seriously boost efficiency and conversion rates. It’s not just about ticking boxes; it’s about transforming how advice is delivered, making the whole process smoother and more effective for everyone involved.

Main Benefits of the Platform

Here’s what makes this advisory platform stand out:

- Compliance: Compliance is handled seamlessly with flexible, compliant flows that take the headache out of regulatory demands.

- Faster Client Onboarding: Automated risk profiling and suitable portfolio proposals speed up the onboarding process.

- Increased Team Efficiency: Instant wealth plan generation and on-the-go signing mean faster conversions.

- Enhanced Client Engagement: Interactive charts and educational modules keep clients involved and informed.

- White-Label Solution: Fully customizable to reflect your unique investment approach and brand identity.

Self-Service Advisory Features

One of the coolest parts? The platform lets clients take the wheel with digital flows for self-assessment. Or, if you prefer, launch your own robo advisor to deliver personalized investment advice tailored to different client segments. This means clients get a hands-on experience, while institutions maintain control over the quality and compliance of advice given.

Empowering Client Advisory

Advisors get a powerful toolkit to perform suitability assessments seamlessly. They can match investors with the right investment products and document everything accurately. The flow is unified and engaging for both advisors and investors—no compromises on your company’s investment philosophy or compliance rules. It’s about making the advisory process smooth, transparent, and effective.

The Investment Engine at the Core

At the heart of this platform lies the investment engine. This isn’t just any engine—it’s an API ecosystem designed to let financial institutions tailor processes to fit their unique advisory approach. It supports all applications on the platform and helps push digital transformation forward in wealth management. Flexibility and innovation, all rolled into one.

Project Impact and Sustainable Development Goals (SDGs)

- SDG 8: Decent Work and Economic Growth – promoting ethical business practices and decent working conditions.

- SDG 9: Industry, Innovation, and Infrastructure – advancing digital transformation in financial services.

- SDG 10: Reduced Inequalities – providing accessible investment advice across different client segments.

- SDG 16: Peace, Justice, and Strong Institutions – ensuring transparency and compliance in advisory processes.

Commitment to Transparency and Ethical Practices

Quantfolio is dedicated to upholding high standards of ethical business practices. The company voluntarily aligns with the principles of the Transparency Act, promoting respect for human rights and ensuring decent working conditions throughout its operations and supply chain. These efforts aren’t just about compliance—they’re about creating a positive impact and maintaining trust with customers, partners, and the wider community. It’s transparency and ethics, front and center.