What is Nordic Alpha Partners?

Nordic Alpha Partners, or NAP, is an industrial greentech fund that’s been making waves since 2017. With around 400 million EUR in assets under management, NAP isn’t your typical investment fund. It’s built on a fresh thesis: that a new, operational value creation toolkit can actually support greentech companies through their scaling phase. This approach opens doors to above-normal return opportunities in sectors where the usual private equity models just don’t cut it. Simply put, NAP spots, de-risks, and scales tomorrow’s green technology leaders, all grounded in solid economic sustainability principles.

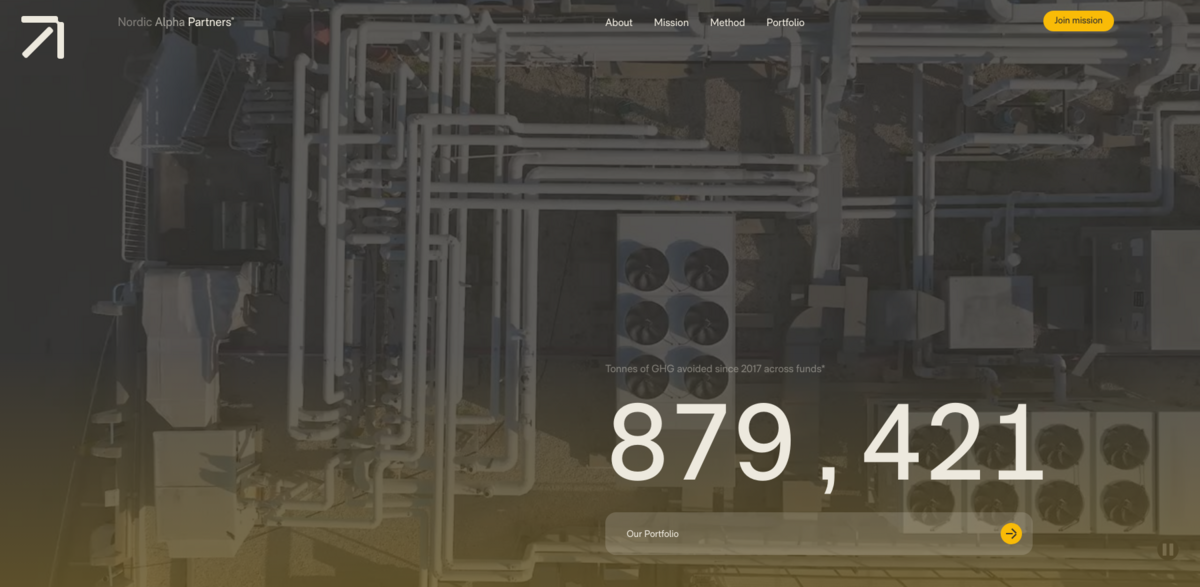

Main Benefits and Key Figures

Here’s a quick snapshot of what makes Nordic Alpha Partners stand out:

- Tonnes of greenhouse gases (GHG) avoided since 2017: 879,421

- Assets under management: ~400 million EUR

- Focus on six sustainable greentech investment areas

- Unique Value Creation Model tailored for industrial greentech

- Operational approach that creates value where few others can

The Mission Behind the Movement

At its core, NAP’s mission is all about spotting, de-risking, and scaling the green tech leaders of tomorrow. But it’s not just about throwing money at ideas. The fund is laser-focused on economic sustainability — finding that sweet spot where sustainable impact meets real growth potential. It’s a smart balance, using a ratio of capital efficiency (gross profit over cost of execution) relative to potential CO2 impact to decide where to put the capital. This means investments aren’t just green for the planet, but green for the wallet too.

Reindustrialisation: Reinventing Industries

The world is reinventing its industries, and this reinvention demands pioneering technology across multiple sectors. Sustainable industry is a massive driver of the green transition and, honestly, it’s creating the largest market opportunity in history. But here’s the kicker: reindustrialisation depends on asset-heavy technology. It’s not something you can fix with balance sheet gymnastics or quick financial tweaks. It’s about real, tangible tech that transforms industries from the ground up.

Hypertransformation: Navigating Complexity

Scaling pioneering technologies isn’t a walk in the park. NAP talks about “Hypertransformation” — a state created by four transformational forces that add layers of complexity during growth:

- Value Chain Disruption

- New Technology Adoption

- Intense Capital Expenditure

- Managing Hypergrowth

Put them together, and you get a whirlwind of challenges that only a specialized, operational approach can handle. NAP’s toolkit is designed to navigate this complexity and help companies thrive in this hypertransformed landscape.

Project Impact: Aligning with Global Goals

- Supports Sustainable Development Goal (SDG) 7: Affordable and Clean Energy

- Advances SDG 9: Industry, Innovation, and Infrastructure

- Contributes to SDG 12: Responsible Consumption and Production

- Helps achieve SDG 13: Climate Action

- Promotes SDG 17: Partnerships for the Goals

About Nordic Alpha Partners’ Portfolio

NAP’s portfolio is a collection of pioneering market leaders operating across six sustainable greentech investment areas. With a unique toolkit and a highly operational approach, the fund creates value where few others can. This hands-on strategy supports companies through the tough scaling phase, ensuring they’re not just surviving but thriving — all while pushing the green transition forward. It’s a smart, forward-thinking approach that’s shaping the future of sustainable industry.