What the Project Is

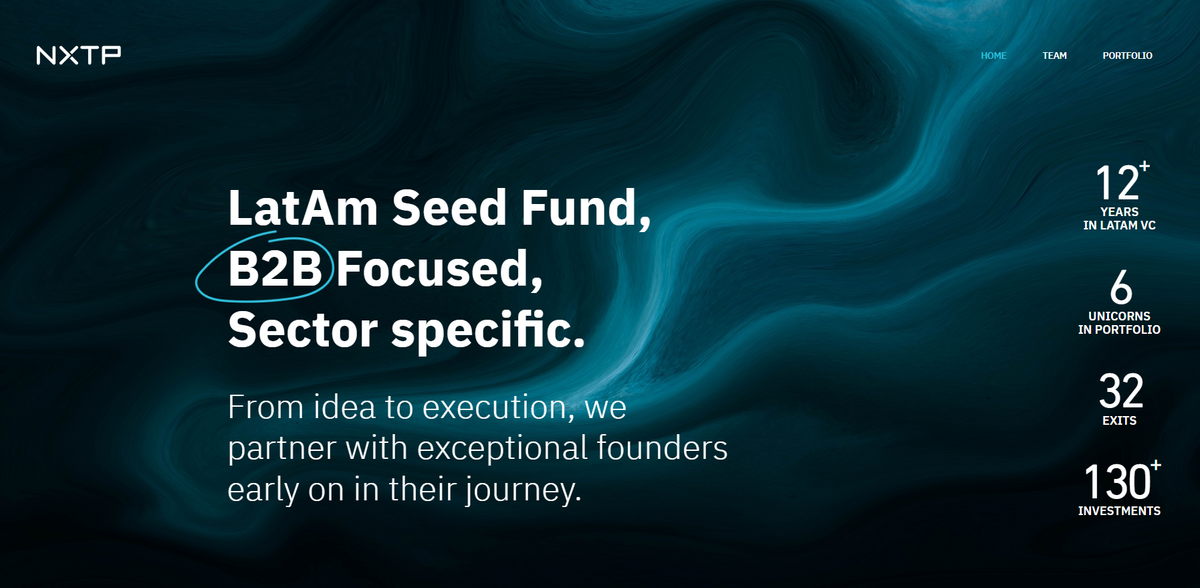

LATAM SEED FUND, B2B FOCUSED, SECTOR SPECIFIC. From idea to execution, this initiative partners with exceptional founders early on in their journey. The project stands out by focusing solely on B2B companies in targeted domains such as Cloud & SaaS, E-commerce Enablers, Fintech, B2B Marketplaces, and AI and Data-Driven Businesses. It is designed to be thesis-driven – not agnostic – ensuring that each investment comes with strong institutional knowledge, built up over years of evaluating thousands of startups and working closely with more than 50 businesses in its core domains. This concentration means that every decision, every partnership, resonates with an understanding of the industry’s pulse… and an appreciation for the innovation at its heart.

Main Benefit

Key figures and facts provide an insightful look at the scale and potential:

- YEARS IN LATAM VC: 0

- UNICORNS IN PORTFOLIO: 0

- EXITS: 0

- Portfolio success stories include Nuvemshop, Latin America’s leading e-commerce platform empowering 85,000+ merchants; Auth0, a renowned enterprise identity & authentication platform acquired by Okta for $6.5bn; and Cobli, a telematics platform set to revolutionize vehicle monitoring across LatAm’s 27 million commercial fleets.

Investment Philosophy and Focus

This fund predominantly invests in early-stage B2B companies – from pre-seed and seed rounds to occasional Series A opportunities. The approach is simple: invest in people. It is never too early to connect, long before a formal round is considered. Whether the startup is in the PowerPoint stage or already approaching Series A, the investment process aligns with both following and leading rounds when appropriate. Typical check sizes for seed rounds range from $500k to $3M USD, while Series A investments usually lie between $2-5M USD. Casual connections often develop into serious partnerships – a warm introduction is ideal, but even a thoughtful cold email or LinkedIn message can make the difference.

Founder Evaluation Criteria

At the center of the investment process is a rigorous evaluation of the founding teams. The quality of the founders is considered the most crucial indicator of success. This assessment includes looking for an unwavering commitment to the company’s mission, strong leadership qualities, clear founder-market fit, and deep domain expertise. Startups must demonstrate intellectual curiosity, a hunger to learn and improve, a data-driven approach to business, and a customer-centric culture. These pointers ensure that every team meets high standards – partly because in the startup world, passion and detailed know-how can be the difference between a brilliant idea and its transformative execution.

Investment Process and Opportunity Evaluation

The methodology for evaluating investment opportunities places emphasis on understanding the founding team, the target market, the product being built, and the underlying business model. Detailed analyses of these factors provide insights into potential growth and scalability. Though the investment process itself is never set in stone, it emphasizes transparency and diligence. The fund’s approach has been refined by years of experience, with decision makers drawing on a wide network of sector-specific experts to help navigate challenges. Interested founders should be prepared to present detailed insights – sometimes even when the delivery is just a PowerPoint presentation, because every piece of the journey is considered, from early ideation to later-stage growth.

News, Updates, and Portfolio Stories

The news section of the project reflects the dynamic nature of the startup ecosystem. Headlines such as “CASH IS KING: LATAM’S TOP-FUNDED STARTUPS GO SHOPPING” capture ongoing trends and challenges faced by many startups, especially in the face of increasingly tight capital markets. There are also inspiring stories like the investment in Inventa after meeting passionate founders, tales of entrepreneurial learning from leaders who authored books like “Entrepreneurial Learning (‘Aprender a Emprender’)”, and narratives on how startups tell stories to themselves and the world. News items highlight not only successes – such as the acquisition of Auth0 by Okta for $6.5B – but also the lessons embedded in every entrepreneurial journey. Stories of innovation are complemented by strategic insights on valuation differences between seed and Series A rounds… and emphasize why quality partnerships matter.

Project Impact

- SDG 8: Decent Work and Economic Growth

- SDG 9: Industry, Innovation and Infrastructure

- SDG 10: Reduced Inequalities

- SDG 17: Partnerships for the Goals

Media and Future Outlook

The project’s news and updates section is an engaging mix of insightful analyses, press releases, and in-depth stories that offer a glimpse into the future of the startup ecosystem in Latin America. Highlights include significant milestones like the seed investment in Cobli and updates on portfolio companies, which are driving trends in e-commerce and technology. A variety of content —from discussions on the importance of entrepreneurial learning to detailed stories about startup evolution— underline a dynamic ecosystem where every innovation leads to new opportunities. It is a space where the constant evolution of ideas is celebrated, and every journey, no matter how challenging, is met with a strategic, well-informed response… leaving the reader energized by the possibilities of what lies ahead.