What is Finhabits?

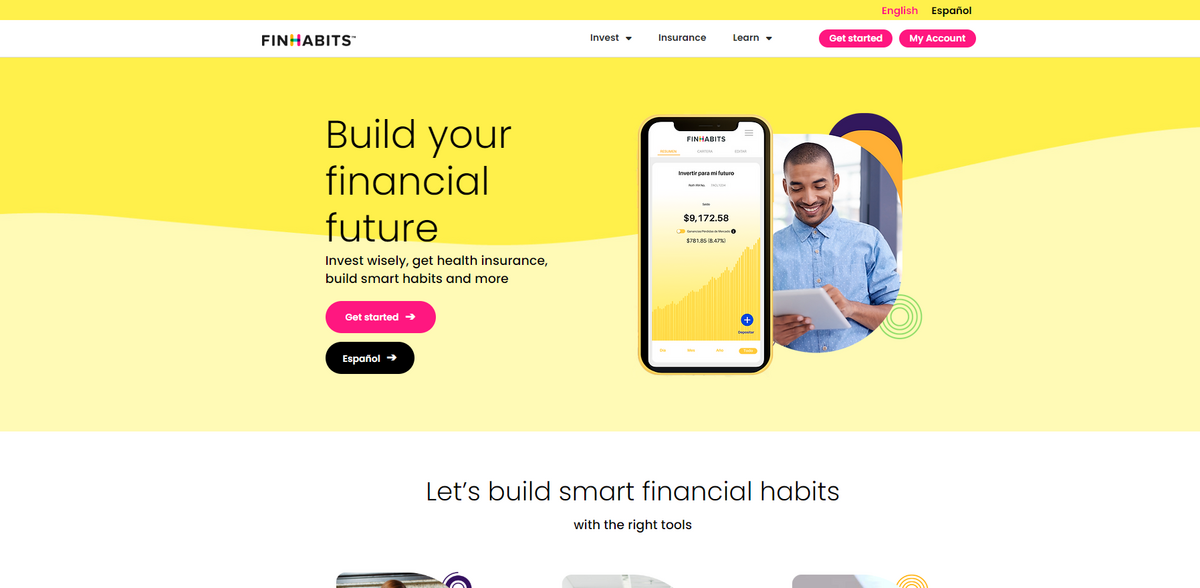

FINANCIAL PLANNING AT YOUR FINGERTIPS – YOUR BEST FINANCIAL FUTURE STARTS TODAY. Finhabits is the bilingual financial wellness platform by Latinos for Latinos that helps individuals build, grow, and protect wealth without needing to be experts. With Finhabits, every feature is crafted to make financial planning feel effortless – from investment account options to insurance quotes all in one place… Choosing smarter means you can quote, compare, and save, all while being guided by Emma, the virtual financial planner designed to simplify decision-making around money.

Main Benefits

Key figures and facts that make Finhabits stand out include:

- CHOOSE SMARTER: Quote, Compare, Save – making it easy to protect what matters while taking care of finances.

- Emma, the Virtual Financial Planner, available in both English and Spanish to provide personalized guidance.

- Account setup made simple: Open an account in minutes and start investing immediately.

- You’re in control – choose how much to invest and how often using an intuitive app interface.

- Bilingual customer support available Monday through Friday for real, friendly assistance.

Diverse Financial Tools

Finhabits offers a blend of education, digital tools, and interactive content to help users form better financial habits. Emma, your virtual financial planner, leads the way with engaging videos and educational content. The initiative emphasizes a diversified portfolio, so investing smartly becomes a natural part of everyday decisions – even if investment expertise isn’t in your background. The platform’s commitment to providing a well-rounded suite of tools means it covers both investment and insurance needs seamlessly.

Easy Account Setup

Starting on the path to a brighter financial future is pleasantly simple. The account opening process takes only minutes, ensuring that finanical accessibility is a top priority. Users can jump right in, determining the amount they wish to invest and setting the frequency conveniently on the app. With a focus on user control, the setup is as straightforward as it gets – a perfect start toward better financial management. And let’s not forget, the bilingual support team is just a call away, providing reassurance and help when needed.

Investment and Protection

Investing smartly is all about diversifying – and that’s clearly highlighted at Finhabits. The platform offers a range of options within the investment account, including Traditional & Roth IRAs and Rollover IRA accounts, allowing users to choose what fits best with their financial goals. At the same time, protection is paramount: get insurance quotes in one convenient location and compare options to select the best protection for what matters most. It’s an all-in-one solution designed to support both your investments and your peace of mind.

Project Impact

- SDG 1: No Poverty – Promoting financial inclusion and providing easy access to diverse financial tools.

- SDG 4: Quality Education – Offering abundant educational content and financial literacy resources.

- SDG 8: Decent Work and Economic Growth – Enabling smart investments that contribute to economic empowerment.

- SDG 10: Reduced Inequalities – Serving the bilingual Latino community by offering tailored guidance in multiple languages.

- SDG 17: Partnerships for the Goals – Integrating a variety of financial services to create comprehensive support.

Engaging Content and Stories

Finhabits doesn’t just offer financial services; it also connects users with engaging stories and up-to-date blogs that give deeper insights into personal finance. How does inflation affect savings, and how can one protect money? Users are reminded of a time when a dozen eggs cost around $2 or a night out felt affordable – a subtle, conversational reminder of the slow rhythm of inflation in action. Also featured are comprehensive guides such as “How to Use an Investment Calculator to Plan Your Financial Future” and “Compound Interest Calculator: How Small Investments Grow into Big Wealth.” These stories serve to illuminate the larger picture of financial management. In addition, practical advice like “The Best Way to Save & Eliminate Credit Card Debt | Where to Invest to Save Money” provides concrete examples of how everyday choices can lead to substantial gains over time.