What is Atmos Financial?

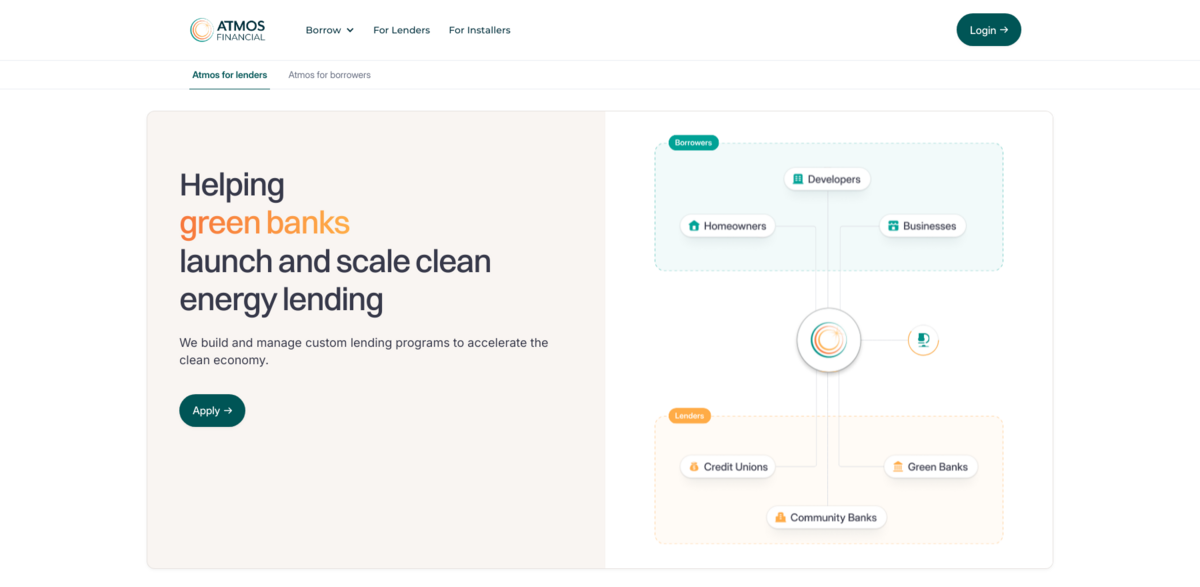

Atmos Financial is a financial technology company—but here’s the thing—it’s not a lender. Instead, it operates a marketplace where all loans are actually made by regulated financial institutions. These institutions follow their own approved underwriting and credit criteria, so the lending process stays secure and compliant. Just a heads up: lending isn’t available everywhere, as it depends on the market you’re in.

The Main Benefit of Atmos Financial

So, what makes Atmos stand out? It’s all about connecting consumers with the right financial products while keeping things transparent and easy to understand. Here are some key points to keep in mind:

- Loans on the Atmos marketplace come from regulated financial institutions, ensuring trust and security.

- Rates and credit requirements can vary across participating lenders, so offers might differ depending on your location.

- When you pre-qualify for a solar or electrification loan, Atmos performs a soft credit inquiry that won’t affect your credit score.

- If you decide to move forward and formally apply, a hard credit inquiry is done, which can impact your credit score.

- Loan repayment information may be reported to credit bureaus, helping build or maintain your credit history.

How Does the Loan Process Work?

It’s pretty straightforward, really. First, you pre-qualify for a loan, which involves a soft credit check—no harm done to your credit score here. If you like what you see and want to proceed, you submit a formal application. That’s when a hard credit inquiry happens, which might affect your score a bit. If approved, you take out the loan, and your repayment activity could be reported to credit bureaus. This process helps keep everything transparent and fair for borrowers.

Location Matters: Why Your Address Counts

One interesting thing about Atmos Financial is that offers can differ based on where you live. That’s because participating lenders serve specific locations, and their rates and credit requirements might vary. So, your project address plays a big role in what loan options you’ll see. It’s a tailored approach, making sure you get the best possible fit for your financial needs.

Atmos Financial and Sustainable Banking

Atmos isn’t just about finance—it’s about sustainable banking too. The company operates within the Deposit bank – Developed Markets industry and carries a B Corp score of 125, which speaks volumes about its commitment to social and environmental performance. This focus aligns with growing consumer demand for responsible financial products that support a greener future.

Project Impact: Linking to Sustainable Development Goals (SDGs)

- SDG 7: Affordable and Clean Energy – by facilitating loans for solar and electrification projects.

- SDG 9: Industry, Innovation, and Infrastructure – through fintech innovation in lending marketplaces.

- SDG 12: Responsible Consumption and Production – by promoting sustainable financial products.

- SDG 13: Climate Action – supporting projects that reduce carbon footprints.

- SDG 17: Partnerships for the Goals – connecting consumers with regulated financial institutions.

Why Atmos Financial Matters in Today’s Market

In a world where financial options can feel overwhelming, Atmos Financial simplifies the process by acting as a trusted intermediary. It helps consumers navigate the complex lending landscape, especially for sustainable projects like solar energy. Plus, by working with regulated lenders and maintaining transparency around credit inquiries, Atmos builds confidence and trust. It’s a smart, forward-thinking approach to finance that meets the needs of today’s eco-conscious borrowers.