What is Algbra Labs?

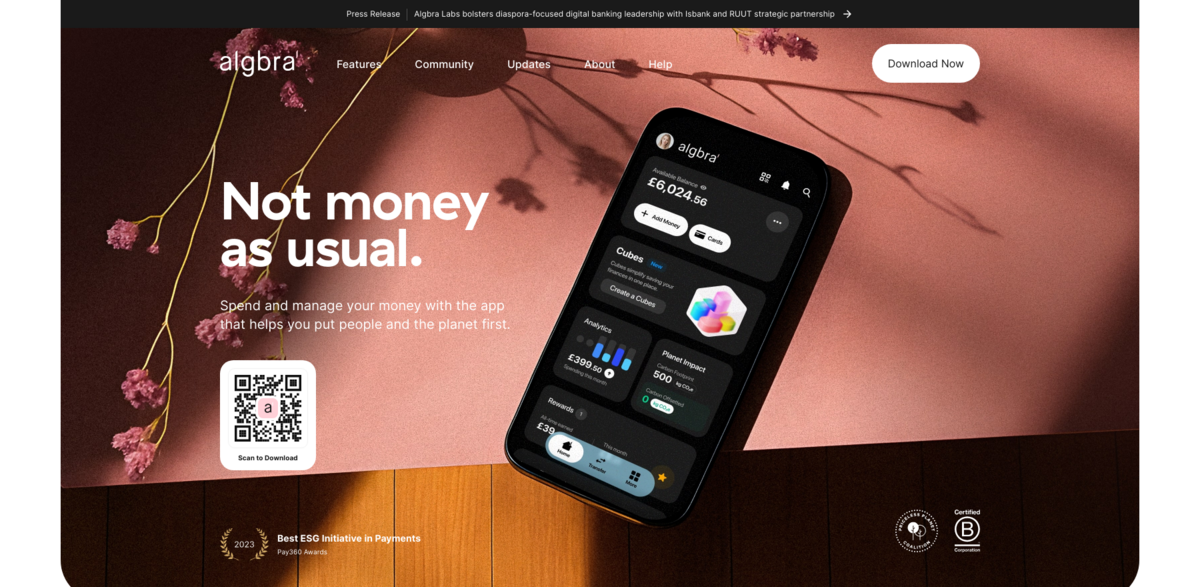

Algbra Labs is shaking up the financial transaction processing industry with a fresh, diaspora-focused digital banking approach. Not your typical bank — it’s a movement. At its core, Algbra is all about combining lived experience and purpose with solid institutional expertise. The company operates under the trading name Algbra FS UK Limited, registered in England and Wales, and is authorised by the Financial Conduct Authority under the Electronic Money Regulations 2011. This means the Algbra Account and Algbra Card are fully regulated, with the card being a Principal member of Mastercard International Incorporated. So, it’s legit, secure, and ready to serve.

Main Benefits of Algbra Labs

Here’s a quick snapshot of what makes Algbra stand out:

- Part of the global B Corp community, meeting high social and environmental impact standards.

- B Corp score of 121.6 — that’s a strong commitment to ethical and sustainable business practices.

- Strategic partnerships with Isbank and RUUT, enhancing diaspora-focused digital banking leadership.

- Expanded Fintech-as-a-Service platform through a new partnership with ClearBank.

- Authorised by the Financial Conduct Authority [FRN 952360] for issuing electronic money.

- Algbra Card is a Mastercard product, ensuring global acceptance and reliability.

- Registered address at 22 Upper Brook Street, London, England — a solid UK base.

Algbra’s Commitment to Social Impact

Social impact isn’t just a side note for Algbra — it’s the heartbeat of their mission. Being part of the B Corp community means they’re held to rigorous standards that measure their impact on workers, customers, the environment, and the community. This isn’t just about banking; it’s about making finance ethical, sustainable, and truly impactful. Their annual report dives deep into their strategy, finances, and operations, complete with an independent auditor’s report. Transparency? Check. Accountability? Absolutely.

Innovative Partnerships Driving Growth

Algbra’s recent strategic partnerships with Isbank and RUUT are game-changers. These collaborations bolster their leadership in diaspora-focused digital banking, opening new doors for communities often overlooked by traditional banks. Plus, teaming up with ClearBank to expand their Fintech-as-a-Service platform means they’re not just growing — they’re evolving the very infrastructure of digital finance. It’s a smart move that blends technology and finance seamlessly.

Technology at the Core

Technology isn’t just a tool for Algbra; it’s the foundation. Their platform leverages cutting-edge fintech solutions to deliver seamless, secure, and user-friendly banking experiences. From issuing electronic money to integrating Mastercard’s global network, Algbra is all about making finance accessible and efficient. The blend of technology and purpose-driven leadership creates a unique space where innovation meets impact.

Project Impact on Sustainable Development Goals (SDGs)

- SDG 8: Decent Work and Economic Growth — promoting inclusive economic opportunities through fintech innovation.

- SDG 9: Industry, Innovation, and Infrastructure — advancing digital banking infrastructure and services.

- SDG 10: Reduced Inequalities — focusing on diaspora communities and underserved populations.

- SDG 12: Responsible Consumption and Production — operating with high ESG standards and sustainability in mind.

- SDG 17: Partnerships for the Goals — leveraging strategic alliances to amplify social and financial impact.

Looking Ahead: The Future of Ethical Finance

Algbra Labs is more than just a fintech company; it’s a beacon for ethical and sustainable finance in the UK and beyond. By embedding social impact into every layer of their operations and partnering with key players in the industry, they’re setting new standards for what digital banking can be. The journey is ongoing, but one thing’s clear — Algbra is here to make a difference, not just in finance, but in the lives of the communities they serve.