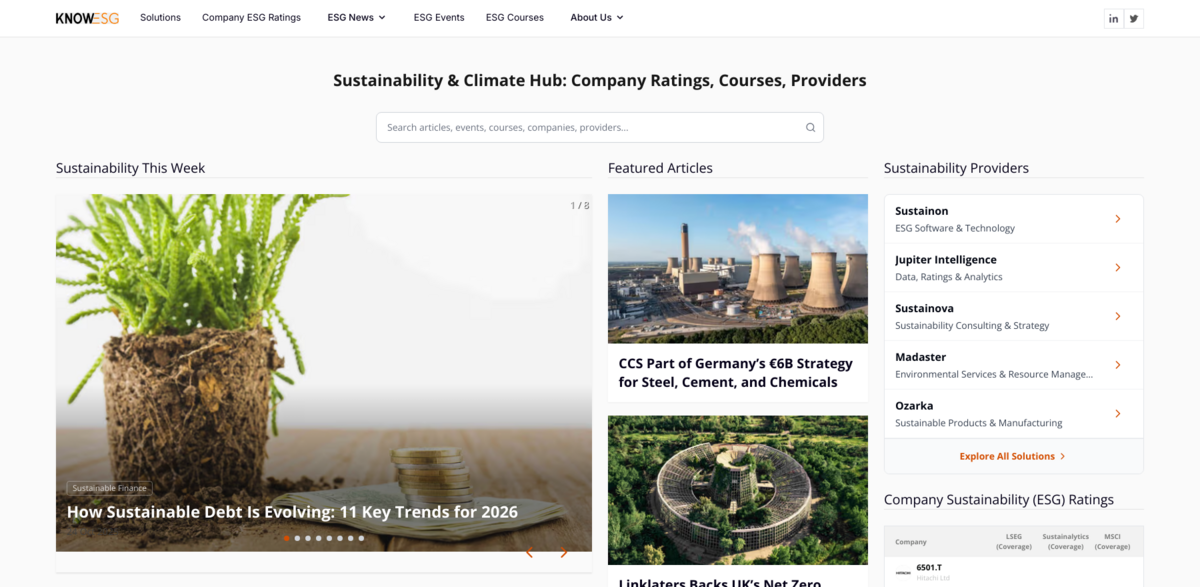

Understanding the Latest Climate & ESG Developments

Climate and ESG news keeps evolving, and the latest updates reveal a mix of progress and challenges. For instance, Nvidia, the $4 trillion AI chip giant, surprisingly lags behind its peers in cutting emissions and adopting renewable energy within its supply chain. Meanwhile, regional examples like Singapore’s carbon-pricing system offer a beacon of hope, showing how localized efforts can drive meaningful change. On the regulatory front, the SEC is tightening rules that separate financial reporting from sustainability disclosures, a move that’s shaking up Canadian markets. And things get even more complex as 16 U.S. State Attorneys General urge tech giants like Microsoft, Google, and Meta not to comply with the EU’s CSRD and CSDDD laws. It’s a lot to take in, but it highlights the dynamic landscape of climate action and corporate responsibility.

Main Benefits and Key Figures in Climate Action

What’s really driving these efforts? Here’s a quick snapshot of the key facts and figures:

- The 2030 Plastics Agenda for Business lays out a clear framework for corporate action on plastics, pushing companies to rethink their environmental impact.

- Ottawa’s recent signal to end the oil and gas emissions cap—after months of uncertainty—comes with important conditions, reflecting a cautious but necessary shift.

- Investor interest is booming in how companies interact with nature, signaling a growing awareness of environmental risks and opportunities.

- The combined platform aims to provide access to data on 10 million companies by year-end, a massive leap for transparency and accountability.

Featured Sustainability Articles Highlight Corporate Accountability

Several high-profile cases are making waves in the sustainability arena. ExxonMobil is pushing back hard against California’s climate transparency laws, showing the tension between corporate interests and regulatory demands. Meanwhile, a Paris court ruled that TotalEnergies misled stakeholders on its climate claims—an important win for accountability. The European Commission is gearing up to start its anti-deforestation law this December, a critical step in protecting global forests. And shareholders are increasingly pushing the National Australia Bank (NAB) to reveal deforestation risks, underscoring the growing power of investors in driving corporate transparency.

Climate & Environment: Challenges and Calls to Action

Climate impacts are hitting home in very real ways. In 2022, millions across Europe struggled just to heat their homes during winter and stay cool in summer heatwaves. As COP30 approaches, nations are under pressure to revisit their climate pledges and refine their Nationally Determined Contributions (NDCs) to make them more workable. The OECD reports that total agricultural support averaged a staggering USD 842 billion per year during 2022–24, highlighting the scale of investment in this sector. Meanwhile, communities in the Philippines have filed a UK case against Shell for losses caused by Super Typhoon events, showing how climate justice is becoming a global issue.

Social & Governance: Navigating New Legal Landscapes

Social and governance issues are also front and center. SAEM recently hosted a discussion on the rising tide of laws and lawsuits that restrict diversity, equity, and inclusion efforts in medical education—a complex and evolving battleground. Asset managers now have more freedom to choose their own strategies for climate-related investments, reflecting a shift toward more flexible, tailored approaches. And a recent KPMG report signals rising CEO morale in AI and clean energy sectors, suggesting optimism about the future despite ongoing challenges.

Project Impact: Linking to Sustainable Development Goals (SDGs)

- SDG 7: Affordable and Clean Energy – through renewable energy adoption and clean tech funding.

- SDG 12: Responsible Consumption and Production – via frameworks like the 2030 Plastics Agenda.

- SDG 13: Climate Action – with tightened regulations and corporate accountability measures.

- SDG 15: Life on Land – supported by anti-deforestation laws and shareholder activism.

- SDG 17: Partnerships for the Goals – through collaborative platforms aiming for transparency across millions of companies.

Sustainable Finance & Technology: Emerging Leaders and Innovations

On the finance and tech front, Abu Dhabi Global Market is celebrating 10 years of growth, evolving from a start-up into a leading global financial hub. Central Retail has set ambitious targets with its Green Bond aiming for net zero by 2050, showing how corporate finance is aligning with sustainability goals. Breakthrough Victoria is funding climate-tech, life sciences, and women entrepreneurs, highlighting the intersection of innovation and inclusivity. These developments illustrate how sustainable finance and technology are becoming powerful engines for change in the climate space.