What the Project Is

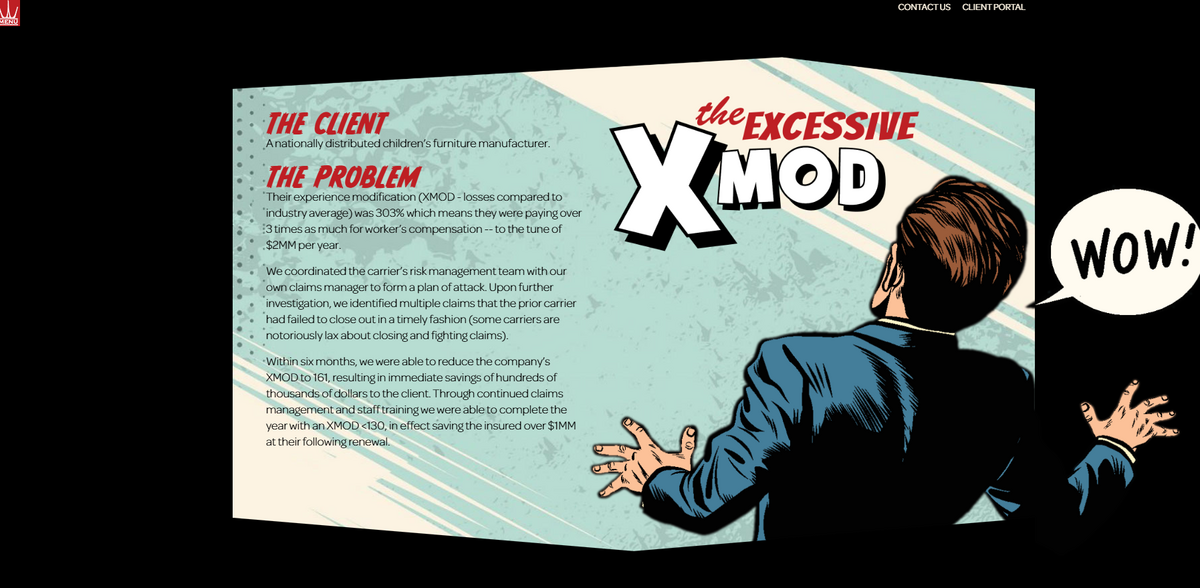

A nationally distributed children’s furniture manufacturer was facing a major challenge with their workers’ compensation costs – their experience modification (XMOD) was 303%, meaning they were paying over three times the industry average, around $2MM per year. The solution involved coordinating the carrier’s risk management team with an internal claims manager to form a plan of attack. A close investigation revealed multiple claims that the prior carrier had neglected to close out promptly… claims that, over time, had snowballed the costs. Within six months, the XMOD was reduced to 161 and then further driven down to below 130 through continued claims management and staff training.

Main Benefit

Key figures and successes from this project include:

- XMOD reduced from a staggering 303% to 161 in just six months.

- Immediate savings totaling hundreds of thousands of dollars for the client.

- Continued improvements led to an XMOD of less than 130 by the end of the year, saving over $1MM at renewal.

- Effective coordination between carrier risk management and claims oversight.

- Bespoke coverage and custom solutions provided for distinct client needs.

Bespoke Coverage Initiatives

At times, standard policies simply do not meet unique client needs – and that’s exactly when unconventional methods come into play. For instance, a pharmaceutical consultant, required to have $15MM of Cyber Liability coverage per a major retailer’s contract, faced initial offers of only $1-2MM from most carriers… until a “stacked” policy was created using three separate $5MM policies from different insurers. Similarly, a law firm needed a very specific type of legal protection coverage that didn’t exist in the U.S.; a direct approach to a Lloyd’s of London stakeholder enabled the creation of this exact coverage. The result was tailored insurance solutions that precisely met long-standing contractual and regulatory requirements.

Innovative Risk Management Approach

Another facet of the project addressed risk management for a mid-sized HVAC contractor who had previously seen a litany of unresolved claims. Instead of simply shopping for different carriers every time a claim emerged, the root cause was identified. Investigations unveiled that employee driving habits were the primary source of the frequent and severe claims. This discovery led to partnering with a vehicle telematics system to proactively monitor these habits, alongside initiating ongoing supervisor education and claims review protocols. Additional toolkit services were introduced, including OSHA compliance to update filing and reporting requirements and an HR services suite to manage problem employees more effectively.

Turnkey Service Solutions

In another interesting application, a newly formed trade organization sought to boost value for its members to drive higher membership dues. The organization’s members, many of whom were new or small businesses, greatly benefited from turnkey services delivered in a co-branded format. These services included OSHA compliance software provided at no cost to the members and an association-based employee benefits plan, which was especially valuable for those struggling with benefits costs. Furthermore, access to an HR technology platform for compliance, training, and live assistance was offered. Such turnkey solutions not only enhanced operational compliance but also contributed to building stronger, more resilient member organizations.

Extended Coverage & Custom Solutions

The project also showcased how creativity and targeted problem solving can lead to custom insurance policies that simply do not exist off the shelf. When a client required a type of coverage so unique that it was not available in standard U.S. offerings, a bespoke approach was taken. By reaching out directly to stakeholders at Lloyd’s of London, an exact match was engineered to meet the specialized needs. It’s a clear example of how unconventional means, when paired with diligent negotiation and strong industry partnerships, can bridge gaps that conventional strategies might leave unattended… delivering exactly what the client needed.

Project Impact

- SDG 3: Good Health and Well-Being

- SDG 4: Quality Education

- SDG 8: Decent Work and Economic Growth

- SDG 9: Industry, Innovation, and Infrastructure

- SDG 10: Reduced Inequalities

Concluding Thoughts

Across multiple initiatives, from drastically reducing worker compensation costs to engineering bespoke insurance solutions for niche needs, this project exemplifies creative problem-solving in the insurance and risk management space. Unwavering commitment to addressing underlying issues, whether by employing vehicle telematics for safer driving practices or by innovating with “stacked” policies, has resulted in significant financial savings and improved operational resilience. The dynamic blend of traditional oversight and modern, technology-driven solutions stands as a sterling example of tailoring risk management to meet the real-life needs of diverse clients… paving the way for safer, more secure and responsible business practices.