What is SoyFocus?

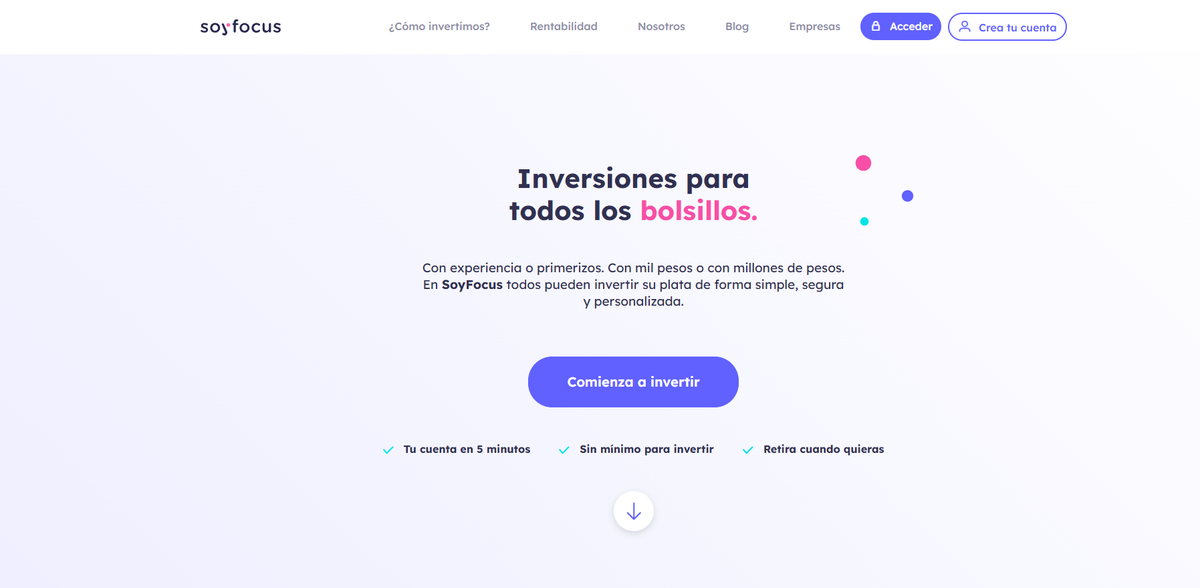

At SoyFocus, investments for all budgets become a reality. Whether someone is a seasoned investor or just starting out, this platform offers a simple, secure, and personalized way to have money work for them. The project is designed for all kinds of people—those with a thousand pesos or millions—and provides an entirely digital investment experience without any paperwork. The account opens in just five minutes, and there is no minimum to invest, ensuring that everyone can reach their financial goals with ease. This investment advising platform in the finance sector combines advanced technology with the expertise of world-class economists, making it a standout option in the investment advising industry.

Main Benefits

- Fast Account Setup: Your account is ready in just five minutes. No delays, no waiting, just quick access to invest.

- No Minimum Investment: Whether it is a small amount or larger sums, there is no minimum required to begin investing.

- Flexibility and Freedom: Investment and withdrawals can be made whenever desired. Your money truly remains yours, working at your pace.

- 100% Digital Experience: The platform ensures that every process is carried out online. Zero paperwork means less hassle and more time focusing on investments.

- Cost-Efficient Fee Structure: With lower charges, more money stays in the investor’s pocket, helping them achieve their financial goals faster.

- Diverse Range of Financial Assets: Investment is made in thousands of financial assets such as ETFs and bonds, ensuring superior diversification with minimal fees.

Diverse Investment Options

Tailored to meet different risk profiles and investment horizons, SoyFocus offers three distinct funds designed to suit various investors: the Conservative Fund, the Moderate Fund, and the Aggressive Fund. The Conservative Fund is ideal for those with low tolerance for losses or who plan to use their funds in the short term. It focuses mainly on a diversified portfolio of lower-risk assets, primarily fixed income funds, and includes up to 30% in stocks. Meanwhile, the Moderate Fund targets those with a medium risk appetite and a medium-term view on their capital, balancing low-risk assets with ETFs, with equities consisting of between 30% and 70% of the portfolio. For investors who are comfortable with market fluctuations and have a medium to long-term outlook, the Aggressive Fund is available. This fund is intended to maximize growth by investing primarily in local and foreign ETFs, with equities making up between 40% and 100% of the portfolio. Each fund is constructed to empower individuals to invest based on their personal goals while enjoying the benefits of wide diversification.

The Investment Strategy

This platform utilizes a passive investment strategy that has been tested over time, relying on a “buy & hold” approach to let money grow at the pace of the market. By employing this strategy—a method deemed so consistently successful it is humorously noted as “worthy of a Nobel® Prize”—SoyFocus emphasizes simplicity and long-term growth. The investment philosophy is centered around three core tenets: passive management, diversification, and recognizing the unique financial identity of each investor. Instead of constantly moving money around based on fleeting market movements, the strategy focuses on a stable approach that minimizes excessive actions. The blend of advanced technology and the research work of top-notch economists ensures that investments are not only smart but also well-suited to each user’s profile. This approach subtly reassures investors who might feel overwhelmed by constant market news and trends, offering a calm and confident path to achieving financial goals, even when market conditions fluctuate… it really is designed with the investor in mind.

Account Accessibility and Security

One of the standout features of SoyFocus is its accessibility. Opening an account is a breeze, taking only five minutes and completely digital. In addition, the platform is dedicated to security. It is legally required to maintain a minimum capital that assures investors of stability. Complementing this regulatory oversight, insurance is provided for each fund, safeguarding the money of investors even if unforeseen circumstances arise. Every fund managed by SoyFocus remains a completely independent entity, so even in the unlikely event that SoyFocus were to cease to exist, regulatory agencies like the CMF would appoint another administrator or return the funds to investors. This commitment to transparency and security reinforces the confidence of investors knowing that their hard-earned money is protected at every step of the investment journey.

Innovative Financial Advice

Investing through SoyFocus is not only efficient but also remarkably straightforward—no arduous paperwork or overwhelming financial jargon. By answering a simple series of questions related to personal goals and risk tolerance, investors help the platform build a tailored recommendation with a personalized combination of mutual funds. The entire process emphasizes inclusivity and ease, ensuring that even those new to investing feel equipped to make wise decisions for their future. The language used throughout the process is engaging and accessible, ensuring that potential users feel at ease and fully understand their journey towards reaching and surpassing their goals. The mix of financial prudence and intuitive digital design gives investors a novel experience that brings traditional investment strategies into the modern era.

Project Impact on SDGs

- SDG 8: Decent Work and Economic Growth – By facilitating accessible and inclusive investment options for everyone.

- SDG 9: Industry, Innovation, and Infrastructure – Through its digital, agile platform that leverages advanced technologies.

- SDG 10: Reduced Inequalities – By enabling individuals from various financial backgrounds to invest, regardless of their starting capital.

- SDG 17: Partnerships for the Goals – Through collaboration between top-tier economists, technology, and regulatory institutions.

Financial Growth in a Digital Age

In an era where digital transformation has reshaped traditional industries, SoyFocus stands as a great example of how financial advisory can be both innovative and accessible. It emphasizes that every investor—whether investing a little or a lot—can enjoy a customized, low-fee, and diversified investment experience. The blend of straightforward account setup, the emphasis on security, and the thoughtful design of its investment strategies makes it easier for individuals to start investing and realize their financial potential. The platform’s commitment is evident in its promise: to ensure that every investor can achieve their dreams by making savvy, informed financial decisions. In doing so, SoyFocus not only fosters personal economic growth but also contributes positively to broader economic and social development, aligning closely with global sustainability goals.