What is Marigold Capital?

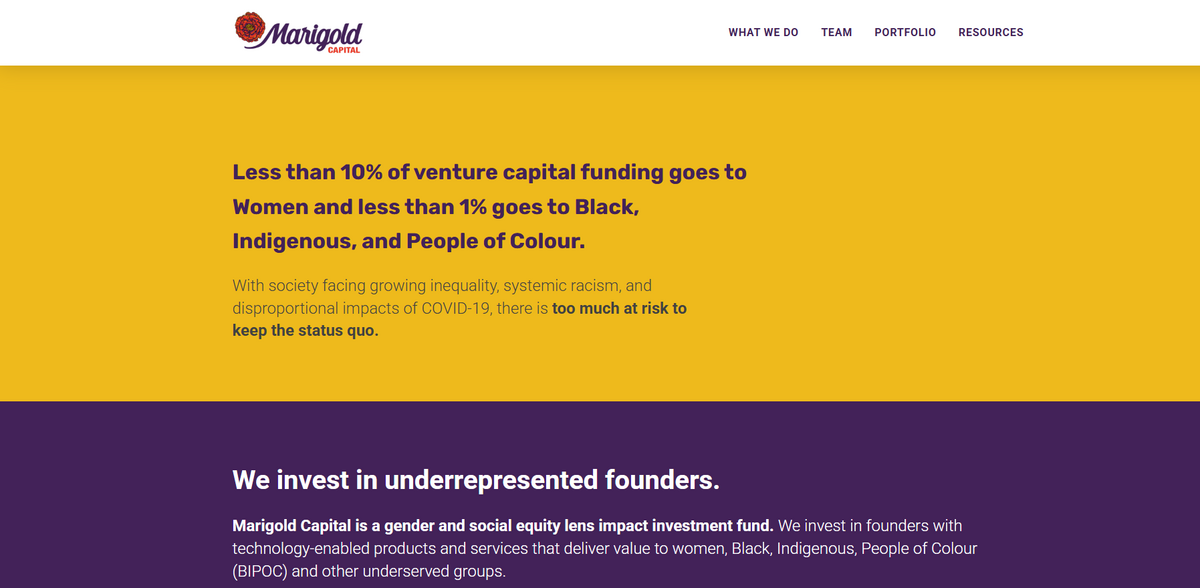

Marigold Capital is a gender and social equity lens impact investment fund that invests in founders with technology-enabled products and services delivering value to women, Black, Indigenous, People of Colour (BIPOC) and other underserved groups. This market opportunity is large, untapped, and overlooked by most VCs… Marigold Capital has a clear vision to support those addressing the world’s greatest social challenges, driven by a belief that social and economic prosperity should be enjoyed by all citizens and communities.

Main Benefits of Impact Investing with Marigold Capital

Marigold Capital’s approach is characterized by a robust blend of financial discipline and social commitment. The fund’s depth of experience and operational rigor have resulted in a portfolio that is both sustainable and strategically sound. Key figures and facts include:

- 20+ years of combined experience managing early-stage impact investments

- Over $105MM in managed capital allocated to various ventures

- Focused investment in founders leading technology companies that drive real social change

- Investments aimed at reducing social and economic barriers

- Support directed specifically to underrated, underrepresented teams

The Investment Thesis

The investment thesis centers on the idea that economic and social prosperity is a right for all, and capital must flow to those neglected by traditional venture capital. Marigold Capital is dedicated to driving financial and social returns while reducing gender-based violence, sexism, racial prejudice, and exploitative business practices. The approach is straightforward: invest in underestimated and undervalued teams, particularly those comprising women and BIPOC, and tap into niche markets within health, social justice + equity, and ethical supply chains…

Commitment to Social and Gender Equity

At the core of Marigold Capital’s strategy lies a steadfast commitment to social and gender equity. Investment decisions are made with precision by applying a lens that promotes diversity across all organizational levels. This doesn’t stop merely at boardrooms—it extends to the company’s supply and value chains, ensuring that diverse decision makers, producers, employees, and users are all part of the process. The emphasis is on strategies that empower marginalized populations and foster economic advancement, health, education, and rights. The work is not just about capital deployment; it is about creating a sustainable ecosystem where inclusive growth is the norm.

Evaluating Company Potential

Marigold Capital takes a deep dive into assessing companies that are capital efficient and financially savvy. The ideal companies are those that hold on to their cash, last longer, and spend less “frivolously” on growth acquisition strategies. These companies know how to hire wisely and retain talent by focusing on margins, unit economics, and organic growth through consistently growing cash flow. Typically, investees are post-revenue with metrics such as monthly recurring revenue of $15,000 or more and annual recurring revenue of $250,000. The diligence extends to evaluating historical data such as CAC, LTV, churn, conversion rates, and other key performance indicators.

Sector Focus and Geographic Reach

Marigold Capital’s investments target companies across two principal geographies – Canadian and US markets. The fund’s thematic interests are broadly divided into Health (Mental Health, Sexual & Reproductive Health & Rights), Social Justice and Equity (Education & Advocacy, Financial Inclusion, Journalism & Media), and Ethical Supply Chains (Food Security, Stakeholder Engagement, Sustainable Fashion)… Each sector is chosen not only for market attractiveness but also because of its potential to yield both financial and social returns. The selection is underpinned by the philosophy that slower-growth, sustainable companies—sometimes referred to as “Camels”—are more resilient and ultimately more impactful than their high-growth, unicorn counterparts.

Project Impact: Linked SDGs

- SDG 3 – Good Health and Wellbeing

- SDG 5 – Gender Equality

- SDG 10 – Reduced Inequalities

- SDG 8 – Decent Work and Economic Growth

- SDG 12 – Responsible Consumption and Production

A Vision for a Sustainable Future

With a belief that real impact demands more than just positive side effects, Marigold Capital is laser-focused on companies that show a resolute commitment toward broad, deep, and mutual impact. Its investment in founders and their ventures is integrally tied to social progress; the goal is not to stumble upon impact by accident but to make it a foundational pillar of every business model. This vision, articulated through a rigorous focus on metrics like revenue resilience and value creation, also highlights the importance of strong teams with dynamic lived experiences and deep sectoral knowledge. The narrative is clear: by directly addressing barriers such as gender-based violence, racial prejudice, and the challenges faced by overlooked markets, a more inclusive and equitable economic landscape is indeed possible… This approach inspires a future where innovation and impact go hand in hand, paving the way for unprecedented social and financial returns.