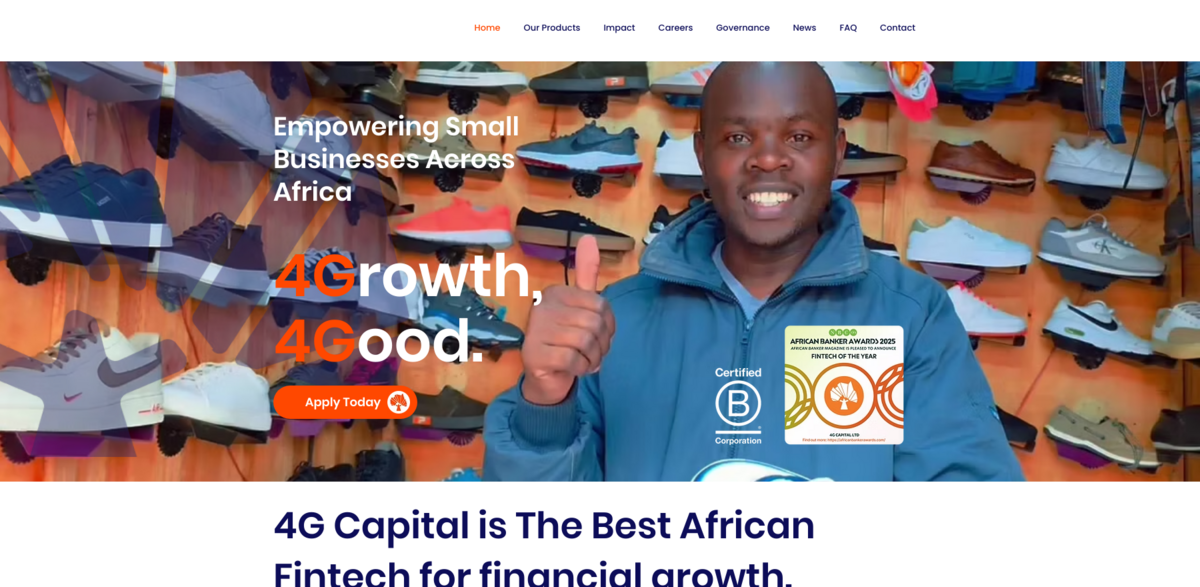

What is 4G Capital?

4G Capital stands out as one of the Best African Fintechs, dedicated to delivering smart business loans, training, and digital financial services that truly help enterprises grow. It’s all about making financing simple, secure, and stress-free through fast mobile money disbursements and repayments. But here’s the twist — every loan comes with customized training via their unique ‘touch-tech’ approach, blending personal support with digital access. This means small businesses across Africa get more than just money; they get the tools and knowledge to unlock opportunities and achieve sustainable growth.

Main Benefits of 4G Capital

Here’s a quick snapshot of what makes 4G Capital a game-changer:

- 12 Years of Operations: Leveraging unbeatable AI accuracy to right-size loans and deliver laser-focused support for small businesses.

- 6.2 Million Loans Delivered: Securely and privately via mobile money, boasting an impressive 87% customer repeat rate and consistently high promoter scores.

- Over 635,500 Customers: Supported with training that enables up to 86% business growth in just one year, building lasting trust and loyalty.

- $780.1 Million Disbursed: Instant repeat loans available on request, any time of day or night, freeing customers to focus on running their busy lives.

Innovative Loan Products Tailored for Growth

4G Capital offers a variety of products designed to meet different business needs. For instance, UPIA by 4G Capital provides an instant business boost with a 30-day loan paired with training to help businesses grow smarter. Then there’s KUZA by 4G Capital, which focuses on financing sales, and KAWI by 4G Capital, aimed at generating sustainable returns. Not to forget NXTGEN by 4G Capital, a partnership program designed for impact. Each product is crafted to support MSMEs in unique ways, making finance accessible and practical.

Commitment to Transparency and Accessibility

One of the standout features of 4G Capital is its commitment to affordability and transparency. There are no hidden charges, fees, or upfront payments — just straightforward, accessible loans designed to empower small businesses. This approach builds trust and encourages financial inclusion, especially for MSMEs that often struggle to access traditional financing options.

Technology Meets Personal Touch

What really sets 4G Capital apart is its ‘touch-tech’ approach. It’s a clever blend of digital technology and personal support, ensuring that borrowers don’t just get funds but also receive tailored training and guidance. This hybrid model helps businesses not only survive but thrive, by combining the convenience of digital access with the human element of personalized coaching.

Project Impact and Sustainable Development Goals (SDGs)

- SDG 1: No Poverty – by providing financial resources to MSMEs, 4G Capital helps reduce poverty through economic empowerment.

- SDG 8: Decent Work and Economic Growth – supporting small businesses to grow sustainably and create jobs.

- SDG 9: Industry, Innovation, and Infrastructure – leveraging fintech innovations to improve financial infrastructure.

- SDG 10: Reduced Inequalities – promoting financial inclusion for underserved communities.

- SDG 17: Partnerships for the Goals – collaborating with various stakeholders to maximize impact.

Driving Financial Inclusion Across Africa

At its core, 4G Capital is about more than just loans — it’s about fostering financial inclusion across Africa’s emerging markets. By combining technology, training, and tailored financial products, it empowers MSMEs to overcome barriers and unlock their full potential. This holistic approach is transforming the microfinance landscape, making it easier for small businesses to access the capital and knowledge they need to succeed.